Ebusco’s revenue dropped 90% in 2024 (with net losses of €200 million)

Ebusco just shared its annual results 2024, where it states it registered a revenue reversal of €16 million, initially recorded in the financial year ended 31 December 2023, following the cancellation of certain bus contracts. Furthermore, Ebusco recorded €18 million of revenues in H1-2024 which were reversed following the same contract cancellations. As a result, […]

Ebusco just shared its annual results 2024, where it states it registered a revenue reversal of €16 million, initially recorded in the financial year ended 31 December 2023, following the cancellation of certain bus contracts. Furthermore, Ebusco recorded €18 million of revenues in H1-2024 which were reversed following the same contract cancellations.

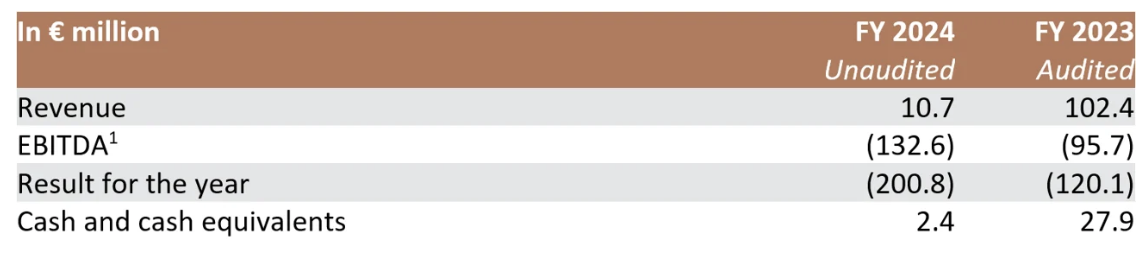

As a result, the turnover for FY 2024 arrived at only €10.7 million, well below the turnover as reported in Ebusco’s interim financial statements per 30 June 2024 (of €38 million). Compared to the 102.4 million of 2023, the company’s revenue dropped 89%. And, due to “overdue payables exceeding its available liquidity”, the company is again on the brink of insolvency.

Back to financial results 2024, the company also recorded EBITDA loss of €132.6 million and net loss for the year of €200.8 million.

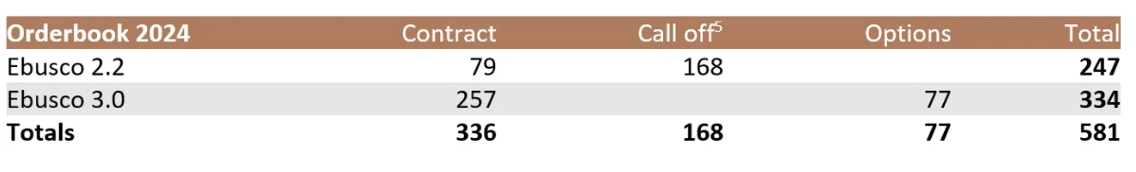

Ebusco ended 2024 with an order book of 581 buses, providing production visibility through the first half of 2026. The company delivered 157 buses during the year. Of the canceled bus orders, 74 units were successfully reassigned to other customers.

Ebusco to keep one location in the NL: Deurne

As part of the Turnaround Plan, Ebusco announced its intention to consolidate its two facilities in the Netherlands into a single facility, as part of the overall cost reduction program and the objective to create a leaner organizational set up. The decision has been made to reallocate the Venray facility to Deurne.

Ebusco’s 2024 was marked by a strategic shift back to an outsourced production model, a major management reshuffle, and the launch of a broad turnaround plan. The year also saw operational setbacks, including a production halt and order cancellations. In November 2024 Ebusco, seeking liquidity, raised EUR 36 million through the successful completion of its Rights Issue. Within a the deal, Chinese battery supplier Gotion took a 9.3% stake in Ebusco and gained access on the bus maker’s supervisory board and board of directors. Gotion’s Duan Wei joined Ebusco as Deputy CEO in March 2025.

What is also important to mention, Ebusco states that the external auditor’s audit process have experienced delays, which prevented completion of the audit within the expected timeframe. Consequently, the 2024 annual report as published today is unaudited.

Ebusco between cancelled orders and reallocation of buses

The company shares that “Due to Ebusco’s financial situation, production nearly came to a standstill in the second half of 2024, resulting in delayed deliveries and the cancellation of 361 buses in 2024 and 55 buses in 2025“. The production of the vast majority of these cancelled buses was not yet initiated, limiting direct financial impact, which ultimately allowed for a more realistic production planning”.

Ebusco company reallocated a total of 74 buses, that were cancelled while being in an advanced stage of production: 21 buses to NIAG, 22 buses for the city of Rouen and 31 buses to EBS. The first reassigned buses for Rouen and NIAG have been delivered and the delivery to EBS will commence in the next weeks. The company expects to reallocate the remaining 19 cancelled buses that are in a more advanced stage of production to existing customers in the second half of 2025.

Potrebbe interessarti

Ebusco, from revolutionary promises to the race for survival

Christian Schreyer, CEO of Ebusco, comments: “2024 has been an extremely challenging year for Ebusco, and 2025 continues to be very challenging. While we have already taken significant steps, we recognize that there is still a long way ahead and the liquidity situation is still a major challenge. It won’t be a surprise that my first months as CEO of Ebusco have been very intensive. I joined Ebusco at a critical moment, in the midst of a massive and urgent turnaround, operationally and financially. When I started in September, my top priority was to improve liquidity and reduce working capital while thoroughly assessing root causes and validating strategic choices. This effort has resulted in a clear, actionable roadmap—comprising several projects for immediate impact along with strategic pillars to guide long-term progress, including the decision to transition to an OED model. An OED model enables us to operate more capital-efficiently and reduce our risk profile. By leveraging our strengths—our top-tier product design and engineering capabilities—while outsourcing processes that have hindered our ability to scale, we can enhance our performance. Combined with other strategic choices, such as simplifying our portfolio to standard bus sizes and focusing on European markets. We are positioning the company to navigate the challenges ahead and ultimately become resilient again”.

Ebusco CEO adds: “The past year has presented significant challenges for the entire organization, demanding extraordinary perseverance from all employees. I extend my sincere appreciation for the continued commitment, resilience, and loyalty shown throughout this difficult period. I am very pleased to have Michel van Maanen on board to oversee Ebusco’s core process at Ebusco and implement the new operating model, bringing invaluable expertise from his proven track record in similar transformations. I would like to thank Jan Piet Valk for his support and guidance as interim CFO until today, which will be his last day at the company. Jan Piet has played a key role for the company in this turbulent period. As of 30 April, Mark de Haas has joined Ebusco as CFO ad interim. As seasoned CFO he is well equipped to guide Ebusco trough the uncertain financial situation”.

“Despite all progress, efforts and envisioned plans, we must acknowledge that even after fully implementing the Turnaround Plan, Ebusco will need a strong partner to be able to scale the business and be sustainably successful – still in CEO’s words -. This also applies to our growing, but still small, Energy storage business. Backed by our strong partner and shareholder Gotion, we see a business case for the Maritime niche market, where we are well positioned as one of the few certified companies. We believe both the Bus and Energy businesses deserve focus, and we are currently exploring strategic options to ensure both businesses can thrive under the right governance. Although the future holds many uncertainties, I believe we are on the right path. Market fundamentals are strong with the electrification trend ongoing. And the market continues to value our product.”