Annual zero-emission bus sales in Europe to double to 21,000 by 2030, McKinsey study finds

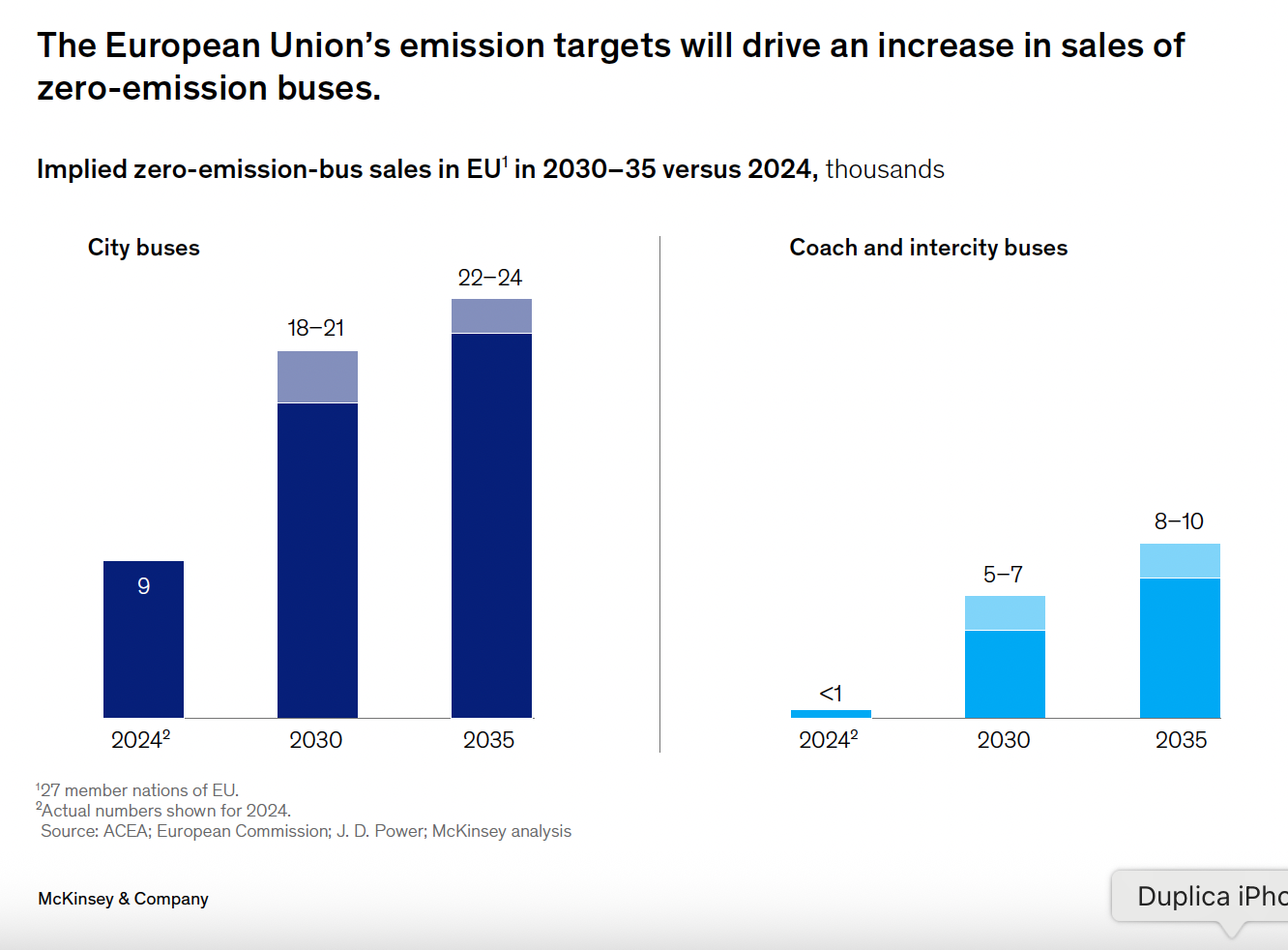

The European electric bus market is projected to grow substantially over the next decade. According to the McKinsey Center for Future Mobility (MCFM)’s study “Don’t miss the bus: New strategies for European bus and coach OEMs”, annual zero-emission (ZE) city bus sales will “increase twofold by 2030—from 9,000 today to between 18,000 and 21,000—to meet […]

The European electric bus market is projected to grow substantially over the next decade. According to the McKinsey Center for Future Mobility (MCFM)’s study “Don’t miss the bus: New strategies for European bus and coach OEMs”, annual zero-emission (ZE) city bus sales will “increase twofold by 2030—from 9,000 today to between 18,000 and 21,000—to meet emissions targets.” Sales for ZE intercity buses and coaches are expected to follow a similar trajectory, with city bus sales projected to reach 22,000–24,000 units annually by 2035 under current regulatory assumptions.

Such predictions, we must underline, implies that the consulting is considering also vehicles over the 8 tons such as minibuses and vans, as the average size of the European bus market over the 8 tons is traditionally not over 15,000 units…

European zero emission bus market and Chinese OEMs

These figures are based on the European Commission’s tailpipe emission reduction policy, though formal revisions are scheduled for 2026, which could influence the final requirements. The study also notes that public transport accounted for approximately 15 percent of passenger kilometers traveled (PKT) in 2023, with buses responsible for more than half of that share, and forecasts a modest increase in public transport PKT to 17 percent by 2035. Over the same period, private-car PKT is expected to decline from 75 percent to 68 percent, reflecting increased adoption of shared mobility and micromobility options.

Back to the bus-related figures, McKinsey’s analysts focus on the expansion of Chinese manufacturers in the European market by stating that “Of all the new companies entering the market, Chinese OEMs have most successfully positioned themselves with their ZE bus offerings, which are mainly in lower price ranges, and now hold a 21 percent share of this segment“. Over the past five years, according to the study, the share of Chinese OEMs in Europe’s ZE bus and coach market has remained between 20 and 25 percent, with 2024 figures reported at 21 percent by McKinsey (however, our calculations based on buses over 8 tons, using DVV Media data, suggest a slightly higher actual share of approximately 30 percent).

What is interesting, the MCFM Bus Buyer Survey indicates that 50 percent of European operators are familiar with leading Chinese bus brands, and nearly 60 percent would consider switching from a European brand if the price were at least 10–20 percent lower.