EU projects 108,000 zero-emission buses and coaches by 2030

By 2030, Europe’s roads could host as many as 108,000 zero-emission buses and coaches, according to a new Market Readiness Analysis about “Expected uptake of alternative fuel heavy-duty vehicles until 2030 and their corresponding infrastructure needs“, released by the European Commission, with analysis by Transport & Mobility Leuven, Ramboll and the University of Antwerp. The […]

By 2030, Europe’s roads could host as many as 108,000 zero-emission buses and coaches, according to a new Market Readiness Analysis about “Expected uptake of alternative fuel heavy-duty vehicles until 2030 and their corresponding infrastructure needs“, released by the European Commission, with analysis by Transport & Mobility Leuven, Ramboll and the University of Antwerp.

The report outlines a projected scenario in which zero-emission vehicles begin to take a substantial share of the heavy-duty segment, with battery electric vehicles (BEVs) expected to play the predominant role in the shift.

As a reference figure, in the period 2012 – 2024 a total of 27,000 electric buses were registered in Europe. The figures highlighted by the EU Commission imply that over 80,000 zero emission buses and coaches should be deployed in the 6-years period 2025 – 2030, meaning an average of 13,000 per year, thus doubling the 2024 figures of +7,000 e-buses (that however includes UK). As the volume of zero emission city buses is quite predictable, as the 90% mandate in 2030 mean that around 10,000 units will be delivered that year, the electrification trajectory of intercity buses and coaches is less certain in terms of foreseeable figures.

Zero emission heavy-duty vehicles in Europe: figures and framework

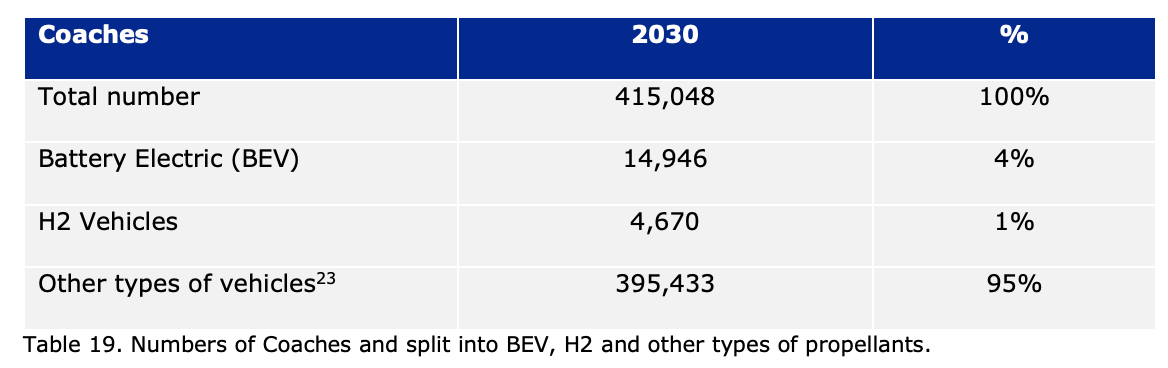

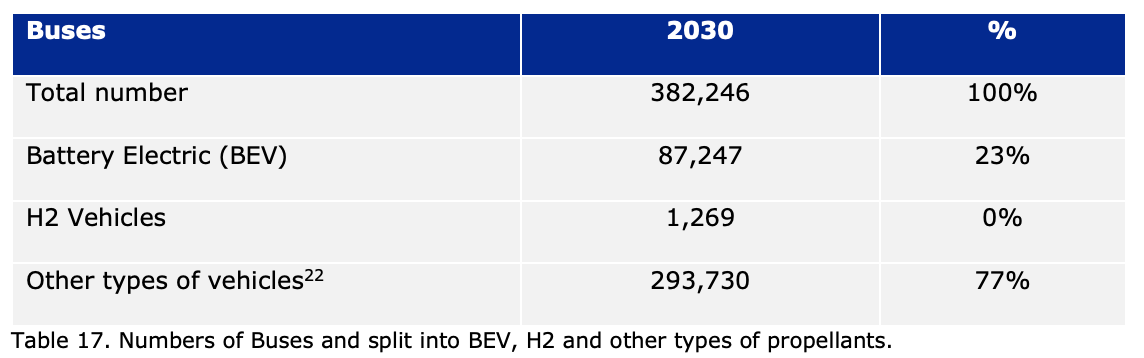

The analysis, developed from quantitative modelling and qualitative stakeholder feedback, envisions a total of 534,000 zero-emission heavy-duty vehicles on the road by the end of the decade. Of these, the vast majority — around 459,000 — would be battery electric. This includes 102,000 buses and coaches, while hydrogen-powered vehicles are expected to represent a much smaller share, with just 6,000 hydrogen buses and coaches foreseen, alongside 68,000 hydrogen trucks.

This policy framework underscores the urgency of a rapid transition: “Efficiency improvements of conventional diesel engines, though important, will not be sufficient to achieve these targets.” As the revised CO₂ standards come into force, they are set to accelerate the shift to zero-emission technologies, particularly in urban transport. The requirement for city buses to be 90% zero-emission by 2030 and 100% by 2035 places battery electric and hydrogen-powered vehicles at the core of fleet strategies. The supporting infrastructure, as outlined in the AFIR, becomes essential—not only to meet these regulatory mandates but also to ensure operational viability across different use cases, from city routes to long-distance travel. Lorries and coaches should in fact reduce their emissions by 43% by 2030 and by 90% by 2040 (with respect to different baseline years).

The study highlights that “The offer of zero-emission models for the bus segment represents the largest part in the overall offer of zero-emission models. There are in fact 59 BEV buses available with ranges that reach 700 km and 15 FCEV bus models. The offer in the coach segment remains very limited. Always according to CALSTART data, considering the announcement up to 2027, only three coach models are available, two of which are FCEV. The lack of models available in the long-haul coach segment was also underlined by stakeholders during the consultation”.

Energy demand in the spotlight

This modelled outcome reflects a broader trend: the electrification of short-haul operations is expected to progress more rapidly than that of long-haul applications. As the study puts it, “short-haul will be the first to decarbonize,” while hydrogen’s role remains primarily reserved for coaches and long-distance trucking, where energy density and range continue to present barriers for battery-electric solutions.

Still, uncertainty looms over the actual energy split between technologies. The study acknowledges that the energy demand projections — 6.5 TWh of electricity and 0.8 TWh of hydrogen for buses and coaches alone — are “affected by the uncertainty of the inputs,” notably future consumption rates and the evolving contribution of hydrogen fuelled vehicles. This uncertainty is compounded by the lack of clarity around which hydrogen drivetrains will eventually prevail: “H₂ICE drivetrains are not explicitly considered,” the study notes, due to their uncertain market potential.

The scenario is designed to align with the EU’s revised CO₂ standards for heavy-duty vehicles. According to the Commission, the projected market shares are compatible with climate policy targets and reflect a mid-to-high ambition pathway. However, the overall contribution of hydrogen remains “considerably smaller” than in some more optimistic forecasts.