European e-bus market up 41% in H1 2025: MAN and BYD expand share, Yutong stays on top

Battery-electric bus registrations in Europe reached 5,315 units in the first half of 2025, extending the upward trajectory seen over the past three years and marking a +41% increase on the first half of 2024 (when 3,751 were registered), based on data provided by DVV Media Group. Just a few days ago full figures of […]

Battery-electric bus registrations in Europe reached 5,315 units in the first half of 2025, extending the upward trajectory seen over the past three years and marking a +41% increase on the first half of 2024 (when 3,751 were registered), based on data provided by DVV Media Group. Just a few days ago full figures of the European commercial vehicles market by ACEA were published and show that 24,695 buses were registered from January to June 2025, 23% of those being ‘electric chargeable vehicles’, which is roughly corresponding with the figures highlighted by DVV Media Group.

From 4,152 units in 2022 to 6,354 in 2023 and a full-year record of 7,779 in 2024, the data confirms continued growth. The first six months of 2025 alone already account for more than two-thirds of last year’s total.

Overall, the data for H1 2025 points to strong gains for manufacturers like MAN and BYD, while others such as Iveco Bus and Wrightbus registered slower starts to the year.

Alongside battery-electric registrations, the European market for fuel cell buses also showed growth. A total of 279 units were registered in the first half of 2025, a 426% growth on the 53 registered in January – June of last year. 2024 ended with a record figure of 378 H2 buses registered… this year we are already at 74% to achieve the same volume.

European e-bus market in the first half of 2025: who is growing?

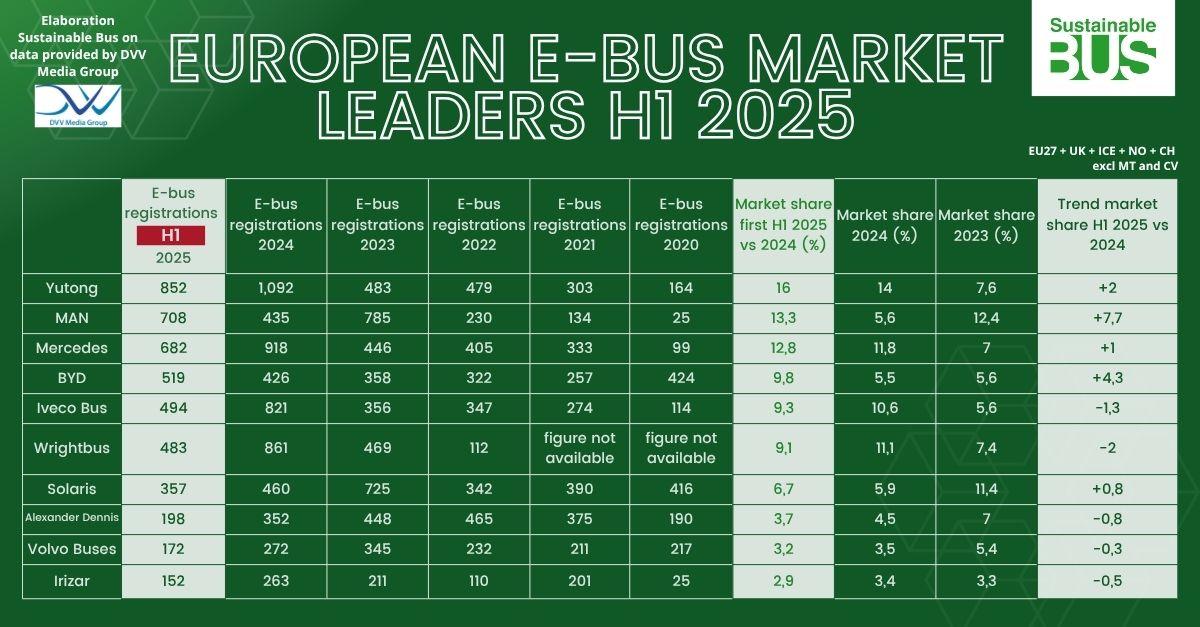

Yutong remains in the lead, with 852 registrations and a market share of 16%, up from 14% during the same period in 2024. MAN follows with 708 units—more than 60% above its full-year 2024 total of 435. This brings MAN’s share to 13.3%, a significant jump from 5.6% in 2024 and a marked recovery after the drop recorded last year.

Daimler Buses (Mercedes) registered 682 battery-electric units in H1 2025, reaching a market share of 12.8%, slightly above its 2024 figure of 11.8%. BYD also posted strong growth: with 519 units registered in the first half of the year, its share rose to 9.8%, up from 5.5% in 2024.

Iveco Bus registered 494 electric buses in H1 2025, equivalent to a 9.3% share—down slightly from 10.6% in the previous year. This follows a peak of 821 units in 2024 and 356 in 2023, pointing to some fluctuation in volumes.

Wrightbus saw its registrations achieving 483 in the first half of 2025, reducing its market share to 9.1%, down from 11.1%. Solaris registered 357 battery-electric buses, translating to a 6.7% share—up from 5.9% in 2024, but well below its 2023 share over 11%. However, we should also consider the dominance of the Polish manufacturer in the fuel cell bus segment, with as many as 163 registrations…

Alexander Dennis recorded 198 registrations and a 3.7% market share, down from 4.5% in 2024. Volvo Buses followed with 172 units and a 3.2% share, slightly below its 3.5% in 2024.

Alexander Dennis recorded 198 registrations and a 3.7% market share, down from 4.5% in 2024. Volvo Buses followed with 172 units and a 3.2% share, slightly below its 3.5% in 2024.

Fuel cell bus market, booming or not?

As mentioned above, 279 units of fuel cell buses were registered in the first half of the year. Solaris accounted for 163 units, representing 58% of the segment. Mercedes followed with 58 registrations (20% market share), while Wrightbus registered 28 units (10%) and CaetanoBus 14 units (5%). Germany recorded the highest number of fuel cell bus registrations with 197 units, accounting for 70.6% of all European deployments in H1 2025. Other registrations were distributed across the Netherlands (25), the United Kingdom (15), France (12), and Italy (7).