“The coach market already offers a viable business case for electrification”. Take MAN’s Barbaros Oktay’s word for it

“Without significant financial incentives or legal mandates, there is little reason for customers to invest in electric vehicles in the intercity bus segment.” After reporting a decline in bus deliveries in early 2025, MAN Truck & Bus has nevertheless seen a sharp increase in incoming orders, highlighting both the challenges of production ramp-ups and the […]

“Without significant financial incentives or legal mandates, there is little reason for customers to invest in electric vehicles in the intercity bus segment.”

After reporting a decline in bus deliveries in early 2025, MAN Truck & Bus has nevertheless seen a sharp increase in incoming orders, highlighting both the challenges of production ramp-ups and the strong market demand for its zero-emission portfolio. The German manufacturer is navigating supply chain constraints, customer expectations for faster delivery times, and a shifting competitive landscape with growing international pressure. Meanwhile, MAN is ready to introduce its first fully electric coach ahead of a standard intercity model, positioning itself directly in the Class III segment where it sees the clearest business case for electrification. The launch will happen at Busworld Europe in October.

In this interview, Barbaros Oktay, Head of Bus at MAN Truck & Bus since March 2023, outlines the company’s industrial priorities, the strategic reasoning behind the coach-first approach, and the measures being taken to stabilize production and margins. He also discusses the role of framework agreements, European subsidies, and the service network as key enablers for a sustainable transition to zero-emission buses and coaches.

In Germany they’re discussing new regulations on accelerated depreciation for electric buses. It might be a very helpful tool. It doesn’t have to be a direct incentive — what matters is enabling our customers to operate economically sustainably.

Barbaros Oktay, Head of Bus, MAN Truck & Bus

Competition in the European bus market

Many manufacturers and automotive industry players in Europe are facing tough industrial decisions. What is MAN’s vision for maintaining its industrial and technological position in the European bus sector amid growing international competition — particularly from the expansion of Far East manufacturers?

We are constantly seeing new players entering the market.. We are from the traditional industrial side, and we will remain in the business. Our strength is our reliability and our long-term presence. We want to be a stable partner to our customers, ensuring product availability and support. Competition keeps us on our toes — and in the end, it benefits the customer.

Many operators complain about delivery times over 12 months from European OEMs. Is this a structural issue?

Yes, it’s a capacity issue. It’s not that we don’t want to deliver — our production facilities are working at full capacity. That’s why we ask our customers to set up framework agreements. With a multi-year planning reliability, we can invest with our suppliers and increase capacity.

OK, so your focus is to try to push on framework agreements and turnkey projects?

Let’s say we kindly invite and motivate our customers. But yes, we would certainly welcome that approach. We always say: if you can provide us with framework agreements, we can engage with our suppliers and help them to increase their capacities. It’s a complete industrial chain. It’s not just about us — our suppliers also need to be ready. And some of these suppliers are highly specialized, with very specific solutions. They need to see a clear long-term perspective in order to justify additional investments.

MAN reported a an 8% drop in bus sales in Q1 2025 (editor’s take: when the interview was held, half year figures were not available yet), while incoming orders rose by 50% year-on-year. How do you interpret this gap between orders and deliveries?

The gap is mainly related to ramp-up challenges with the 2024 model year, particularly the introduction of a new electronics platform. Right now, we can say that things are back on track. Most of the backlog has been cleared, and we expect full normalization during Q3 2025.

Adjusted operating margin declined in Q1. Was this a temporary fluctuation or did you implement countermeasures?

We have already started some countermeasures. But we believe things will normalize by the end of the year. The first quarter was impacted by postponed deliveries and by the extraordinary efforts required to recover and deliver vehicles to customers. Now, we’re getting back on track.

“We need more clarity and continuity in subsidies”

What kind of support do you expect from European institutions?

We need more clarity and continuity in subsidies. In Germany and Austria, for example, urban bus subsidies are already exhausted — and we’re still just at the beginning of the zero-emission journey. Our customers need support, not just for the vehicles, but also for the infrastructure. You can’t sell a mobile phone without a network, to use this comparison as an example. Right now, our bus business is ahead of public investment in charging infrastructure — and we need to align this.

There’s ongoing discussion that EU incentives should primarily support European manufacturers. Is this a strategic issue for you?

This is currently a topic within ACEA. Together with other European manufacturers, we’re working to highlight two priorities to policymakers: continuity of support for electric mobility and acceleration of infrastructure rollout.

Beyond direct subsidies, do you see alternative support mechanisms for the transition?

Absolutely. For example, in Germany they’re discussing new regulations on accelerated depreciation for electric buses. It might be a very helpful tool. It doesn’t have to be a direct incentive — what matters is enabling our customers to operate economically sustainably.

Can leasing play a role in accelerating adoption?

We already offer leasing via our financing arm, but only for private operators. In Germany, for example, public transport companies are still not allowed to use it. But we are ready as soon as the legal framework allows it.

What about the electrification of the intercity bus segment?

You’ve launched your first electric coach before a normal floor electric intercity bus. That’s surprising, given the growing interest in Class II vehicles. Why this strategy?

The intercity bus market is dominated by only a few competitors. The customers in this segment are primarily focused on low purchase prices. They often use these buses for simple purposes such as school transportation or similar operations, where cost-efficiency is a major driver.

From our product strategy perspective, these areas of application are unlikely to be electrified as broadly as some might expect.

Why not?

The reality is that subsidies are limited and the regulatory push is not strong enough to motivate widespread adoption. Without significant financial incentives or legal mandates, there is little reason for customers to invest in electric vehicles in the intercity bus segment.

Today, however, without such pushes or strong subsidies, we do not believe that the adoption rate will grow substantially in this segment. That said, while we have a strong presence in Class I with our electric low floor buses and low-entry models, and we offer some Class II low-entry solutions for customers who specifically require them, our main focus is shifting from Class I directly to Class III.

This shift is based on extensive market research and close exchanges with our customers, which have shown a clear demand for Class III zero emission vehicles. This segment offers an attractive business case as the total cost of ownership (TCO) we provide gives our customers a real competitive advantage. Thus, we see a clear business opportunity in Class III.

The business case of electric coaches

And for electric coaches, is there a business case? Even without subsidies?

Yes — we already see a business case in specific segments. The coach market is very diverse: tourism, long-distance, charter. Not every sub-segment is ready, but some are, today. Their usage profiles and daily ranges match what we can offer. We wantto be there right away with a product that fits those existing customer needs. It doesn’t make sense to wait until 100 percent of the market is ready. Let’s start where it already is.

Your electric coach is currently only available in a 14-meter version. When will we see a standard 12 or 13-meter coach?

We start with the Lion’s Coach 14 E because it fits the segments where there’s already a viable business case. Technically, we can go longer or shorter. But basically our product offer must meet the current customer requirements.

Last question on the service network. Servicing city buses looks easier: they are concentrated in a city, and you can equip your workshop and partners nearby. Very different is the case of coaches, where prompt service should be ensured on a wide international network…

When talking about service network, never underestimate the power of having a truck and bus company behind it. A truck and bus company can provide much stronger service coverage than a single bus company. That’s why some competitors focus only on city buses — they don’t have the international network to support coaches, which is a big competitive advantage. I’d like to make, first, a few steps behind.

Please…

In this niche bus market — and in automotive generally — volumes mean more, compared to any other industry sector. The quantity of vehicles you produce defines your importance in front of suppliers and affects your serviceability.

If you buy 600 parts a year, that’s very different from buying 65,000 or 70,000 parts annually. Your influence changes dramatically. For example, if I call a supplier with a problem affecting 600 units, the supplier’s ability and incentive to respond and improve is very different than if the issue affects tens of thousands of units.

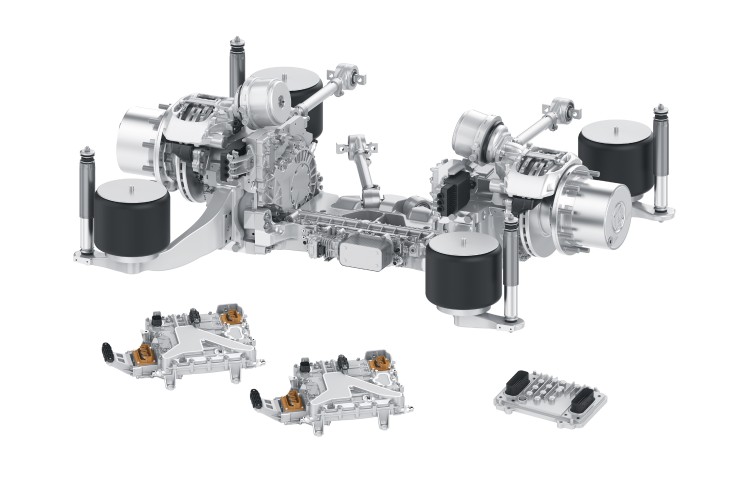

Think back to the early days of ramping up city buses — our truck division wasn’t involved, and these were purely dedicated city bus concepts with limited synergies with trucks. Now, up to 85 percent of the components and systems we will use in our electric coaches are shared with our eTrucks. So, when it comes to mechanic competence worldwide, technicians trained on trucks will also be trained to work on our coaches. Likewise, systems support from suppliers benefits both product lines due to the large numbers involved.

This means that once the electric truck service network is established, it also supports the electric coaches. If you buy an electric coach from us, you can visit any MAN service station worldwide, and they will be able to service your vehicle.