New study in Santiago, Chile shows that electric buses have lower TCO than diesel

Below, a contribution from ZEBRA (Zero Emission Bus Rapid-deployment Accelerator), a partnership led by C40 Cities and the International Council on Clean Transportation (ICCT), with funding from P4G. This international alliance works to support the deployment of over 3,000 electric buses onto the streets of Latin American cities. Sustainable Bus acts as media partner. It’s the first of a series […]

Below, a contribution from ZEBRA (Zero Emission Bus Rapid-deployment Accelerator), a partnership led by C40 Cities and the International Council on Clean Transportation (ICCT), with funding from P4G. This international alliance works to support the deployment of over 3,000 electric buses onto the streets of Latin American cities. Sustainable Bus acts as media partner.

It’s the first of a series of articles focusing on the electrification of bus fleets in the region.

Feedbacks, questions and contributions are welcome (at info@sustainable-bus.com)

In 2019, Santiago’s Public Transport System (RED Metropolitana de Movilidad, formerly Transantiago) began a process of reconfiguring the business model of their entire system. Some of the major changes included separating provision from fleet operation to incorporate more efficient technology, reducing the number of business units for the operation, modifying the timing of the contracts for these services, encouraging competition, and improving the quality of the service for the end-user.

Read the full paper (in Spanish) here: https://theicct.org/wp-content/uploads/2022/07/lat-am-hvs-evs-zebra-costo-total-propiedad-buses-electricos-santiago-jul22.pdf

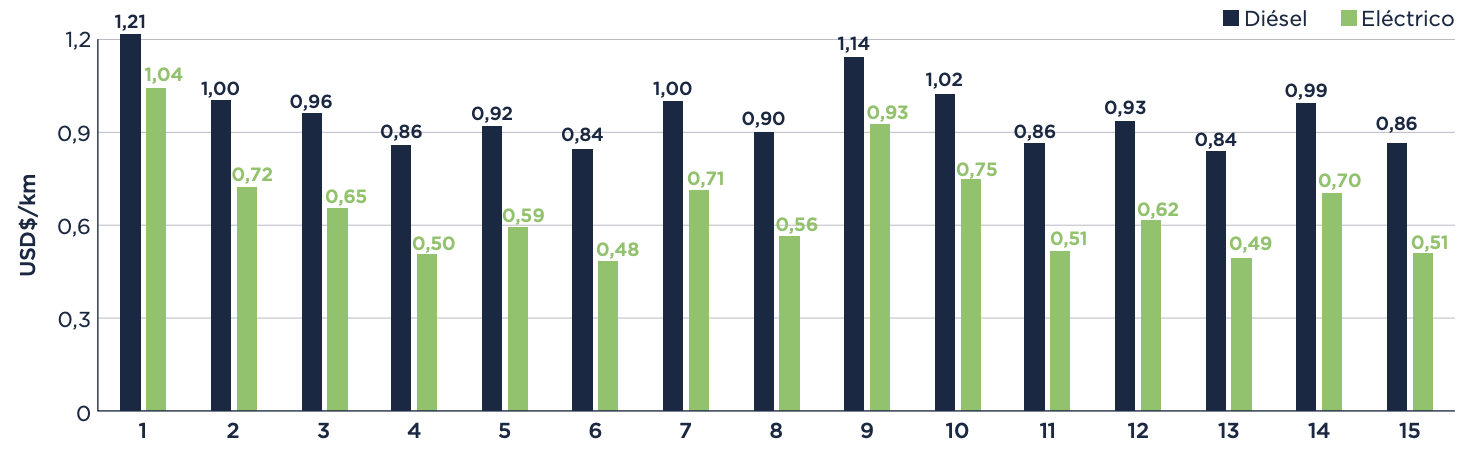

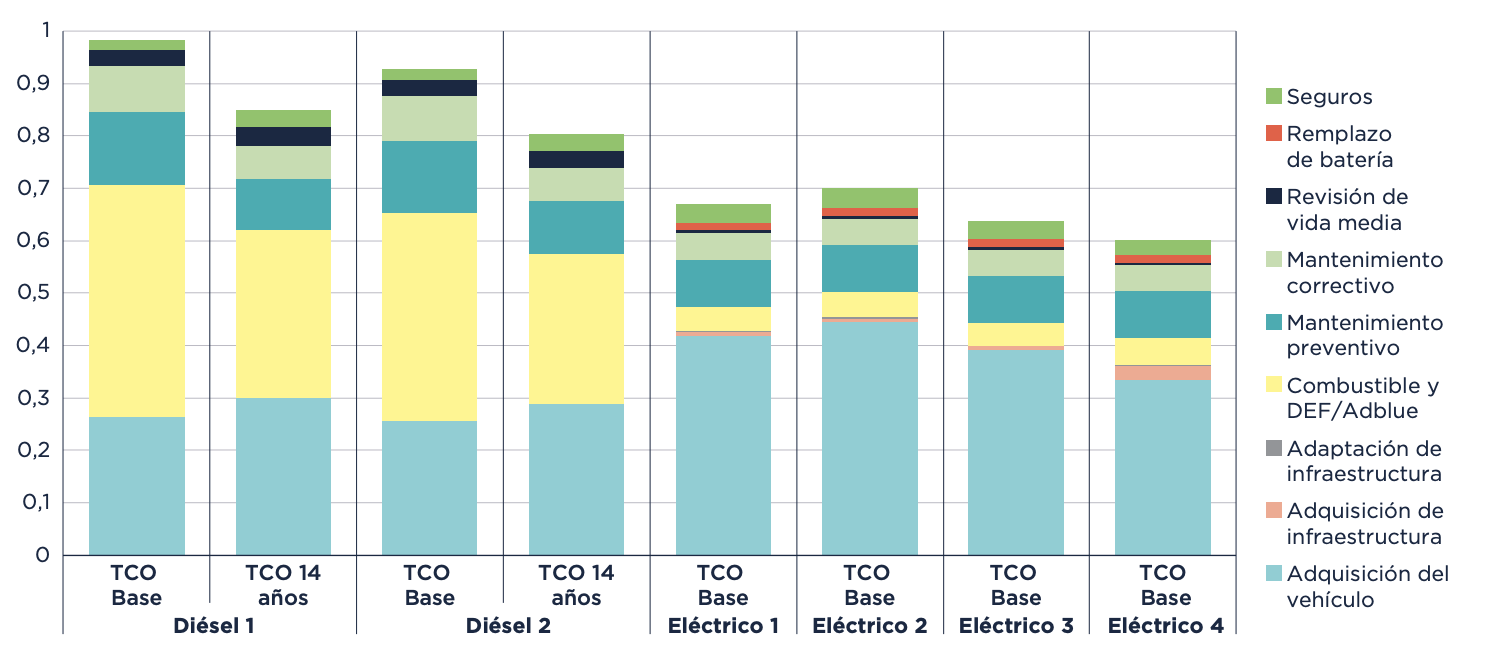

Results show that even with higher investment costs and equalizing the duration of the concession contracts, the adoption of electric buses in the public transport system of Santiago continues to be more economically viable. The economic competitiveness of electric buses resulted in a TCO 32% lower than the TCO of their diesel counterparts.

Zero emission buses in Santiago RED system

The incorporation of electric technologies to the RED system, coupled with the change in the business model, has generated doubts about the long-term profitability and viability of the service, despite the fact that this new model allows the inclusion of more actors.

Centro Mario Molina Chile, together with the ZEBRA (Zero Emission Bus Rapid-deployment Accelerator) partnership of C40 and ICCT, conducted a study that seeks transparency of the total cost of ownership (TCO) associated with the new configuration of the model. This study builds on previous case studies about the Metbus business model and the pilots to scale experience in Santiago. In this new study, a base scenario framed by the recent bids for the supply and operation of the Metropolitan Mobility Network has been reconstructed, with the goal of understanding the magnitude of the cost impacts for each technology due to the change.

The study is based mainly on the information contained in the contracts signed for the provision of both diesel and electric urban buses. These are lease contracts with a purchase option––known as leasing and locally called “supply contracts”––signed between the Ministry of Transport and Telecommunications and the fleet supplier.

Results show that even with higher investment costs and equalizing the duration of the concession contracts, the adoption of electric buses in the public transport system of Santiago continues to be more economically viable. The economic competitiveness of electric buses resulted in a TCO 32% lower than the TCO of their diesel counterparts.

Under the new business model, the financial risks of acquiring electric buses are substantially reduced, even with these new paradigm changes and a technology still in its infancy in its large-scale operations. The new tender also reduced the size of concessions to an average of 400 buses per operator, which allowed efforts to be focused on fully complying with the operational program designated by the regulatory entity, DTPM.

Infrastructure costs are also a factor. The current electric bus operators are required by contract to make the electrical infrastructure more efficient, using a charger for 3.75 buses, instead of the usual two. This new ratio saves about 40% in charging costs. When fleet management and charging strategy are improved, as was the case in Santiago, it is possible to improve the bus-per-charger ratio and further save costs.

This study, while catered to the Chilean market, underlines the variables that most influence the costs of a general diesel bus operational concession compared to electric buses, such as contract length, maintenance frequency, and diesel price volatility. These key aspects must be considered in future concession contracts and/or fleet supply tenders.