Daimler Truck: strong bus segment performance supports group margins in a challenging Q1 2025

Daimler Truck started 2025 recording declining volumes (both sales and backlog) and financial performances within mounting macroeconomic uncertainties. Among the main contributors to this resilience was Daimler Buses, which recorded all positive results and played a key role in supporting the Group’s industrial margin, according to the just-released Q1 results. It’s the confirmation of a […]

Daimler Truck started 2025 recording declining volumes (both sales and backlog) and financial performances within mounting macroeconomic uncertainties. Among the main contributors to this resilience was Daimler Buses, which recorded all positive results and played a key role in supporting the Group’s industrial margin, according to the just-released Q1 results. It’s the confirmation of a trend already in place in 2024: last year Daimler Buses was the best performing — and almost the only growing — division of Daimler Truck.

Daimler Buses helps lift group profitability

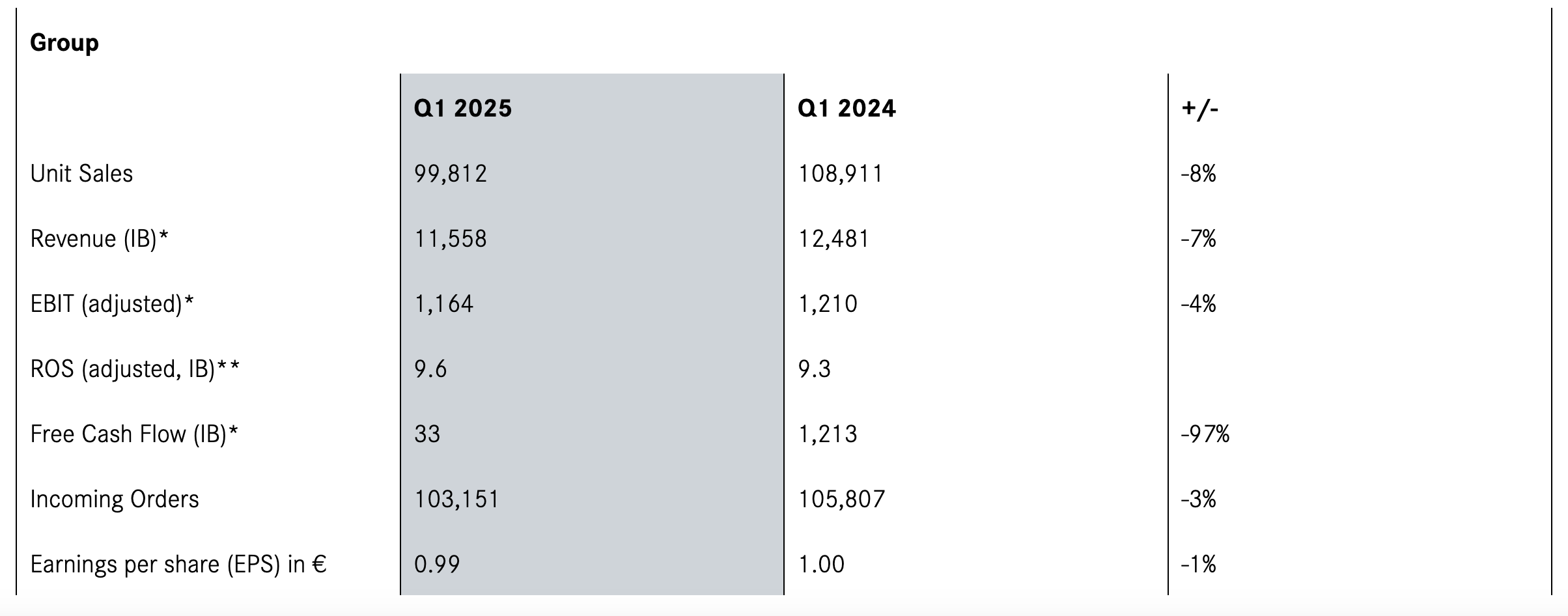

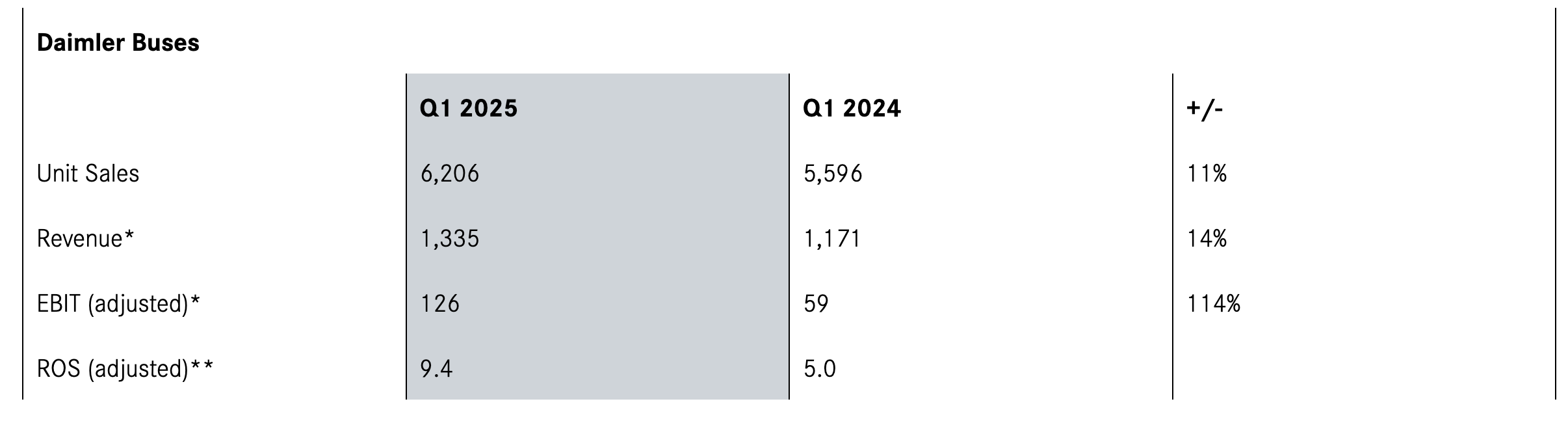

In a quarter where the Group’s industrial return on sales (adjusted ROS) rose to 9.6% (up from 9.3% in Q1 2024), Daimler Buses was explicitly credited as one of the drivers of profitability. This performance came amid a decline in overall sales volumes: Daimler Truck delivered 99,812 vehicles globally, compared to 108,911 in the first quarter of 2024 (-8%).

Daimler Buses, on the contrary, had +11% units delivered: 6,206 vs 5,596. Revenues also rose +14% and EBIT +114%.

Sales of zero-emission vehicles (ZEVs)—which include battery-electric buses—stood at 759 units in Q1 (versus 813 in Q1 2024), while incoming orders for ZEVs increased to 1,266 units, up from 1,146 a year earlier.

At a group level, Daimler Truck posted €11.6 billion in Industrial Business revenue, down from €12.5 billion in Q1 2024, and €1.16 billion in adjusted Group EBIT, compared to €1.21 billion in the same period last year. Free cash flow for the Industrial Business dropped to €33 million, after reaching €1.2 billion in Q1 2024.

Weaker incoming orders in North America—down 29% year-on-year—prompted a downward revision of the Group’s 2025 sales guidance, now expected at 430,000–460,000 units (previously 460,000–480,000), and Industrial Business revenue of €48–51 billion (previously €52–54 billion). The outlook for Group EBIT growth was lowered to -5% to +5%, from a previous +5% to +15%.

Despite these adjustments, Daimler Truck states it maintained its margin targets, projecting an 8–10% adjusted ROS for the Industrial Business in 2025.