Europe already outpaces 2024 in BEV bus registrations: +8K in first 9 months of 2025 (fuel cell buses growing 163%)

This year Europe has already outpaced 2024 in electric bus registrations, with more battery-electric buses registered in the first nine months of 2025 than in the whole of last year. Between January and September, 8,051 buses (>8 t) were in fact registered across the continent, according to DVV Media Group. Compared to the same period […]

This year Europe has already outpaced 2024 in electric bus registrations, with more battery-electric buses registered in the first nine months of 2025 than in the whole of last year. Between January and September, 8,051 buses (>8 t) were in fact registered across the continent, according to DVV Media Group.

Compared to the same period of 2024, this year saw 2,565 more e-buses registered, even to a +46% increase. CNG buses decreased -10% while fuel cell buses are growing 163% reaching 408 units (266 in Germany).

ACEA data, out in early November, confirmed the trend: in the European Union, BEV registrations reached 6,444 units, up 49% year-on-year, rising to 9,346 when including the United Kingdom and EFTA countries (+52%).

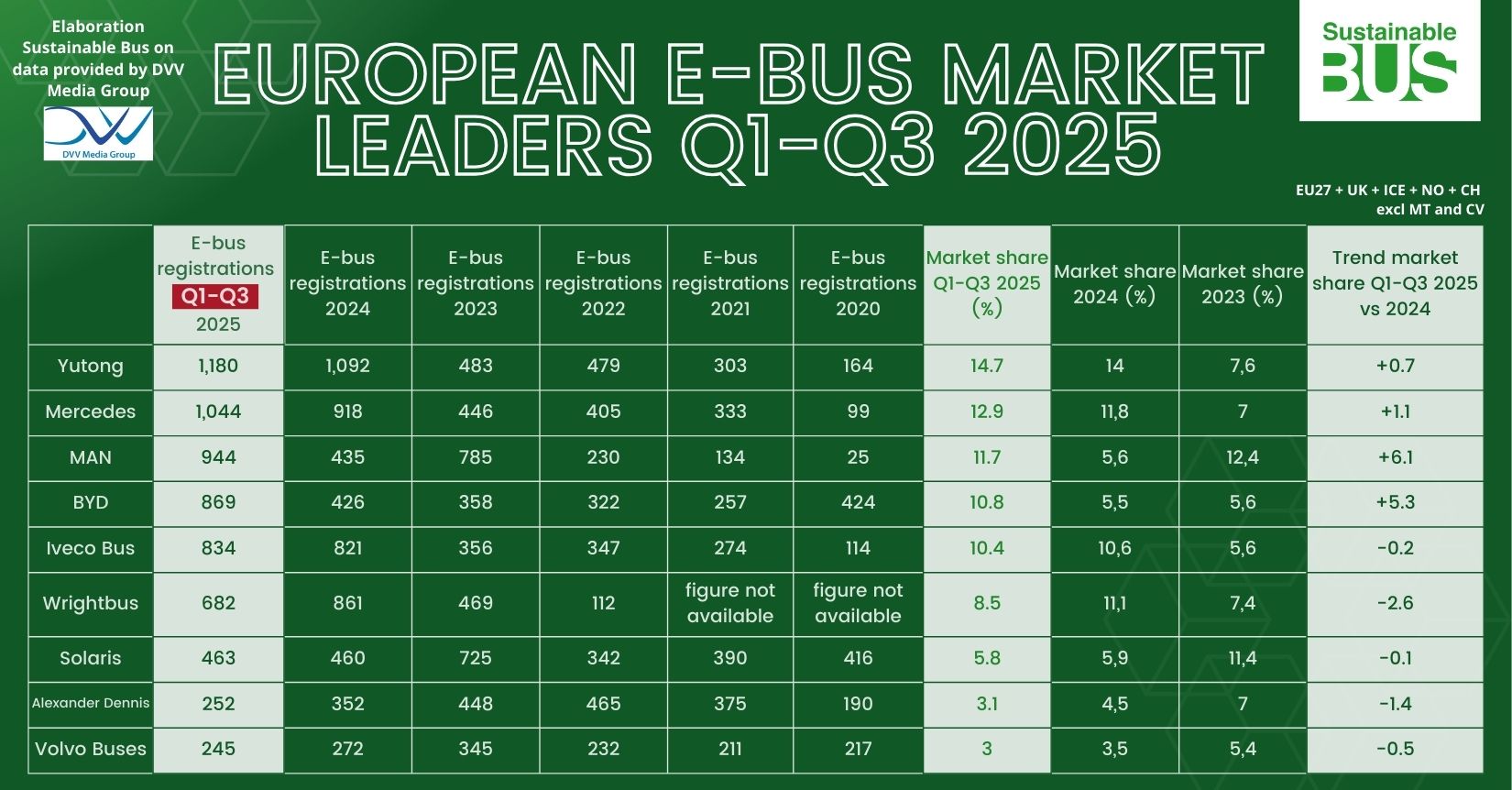

Yutong retains its lead in the European BEV market with 1,180 units and a 14.7% market share, improving on its 2024 performance. Daimler Buses follows with 1,044 units, while MAN continues its strong upward trajectory with 944 registrations (11.7%), already doubling its full-year 2024 total.

Market leaders and top performing countries

BYD recorded 869 units (10.8%) and is also significantly growing on 2024 and previous years, while Iveco/Heuliez reached 834 (10.4%) and is already at the same level as in the full year 2024 (and staying constant in terms of market share). Wrightbus follows with 682 registrations, Solaris with 463, Alexander Dennis with 252, and Volvo with 245, each maintaining stable but slower growth compared to the top performers.

The United Kingdom remains the largest electric bus market in Europe, with 1,866 BEVs registered in Q1–Q3, representing 23.2% of the total. It practically doubles the performance of Germany, at the seconde place, standing at 972 units (12.1%), while Italy posts an impressive 786 registrations (9.8%).

Sweden (689), Belgium (661, +389% per ACEA), Norway (454), and France (418) complete the group of high-volume markets. The Netherlands (395) and Spain (311) show stable activity, while Denmark and Romania both exceed 250 units.

“Non-diesel” technologies and fleet transition

The wider “not-diesel” segment—including electric, hybrid, CNG/NGT and fuel cell buses—reached 11,910 units in the first three quarters, compared to 10,189 in the same period of 2024. Growth is driven primarily by battery-electric buses with 8,051 registrations, while hybrids decline sharply from 2,538 to 1,677 units (-861). Fuel cell buses, on the other hand, rise from 155 to 408 units, an increase of 263.

CNG demand remains strong in France (862) and Italy (564): taken together, these two countries cover 80 percent of the market.

Hydrogen buses: fast growth, still a niche

A total of 408 fuel cell buses were registered in Q1–Q3 2025—more than double the volume of the previous year. Solaris leads the market with 222 units and a dominant 54% share, followed by Daimler Buses (74), Wrightbus (41) and CaetanoBus (39).

Germany accounts for 266 registrations, equal to 65% of the entire European hydrogen bus market. France follows far behind with 43 units, while the Netherlands (25), Austria (21) and Poland (20) show moderate activity.