Proterra seeks Chapter 11 bankruptcy protection

Proterra has filed for Chapter 11 protection in a bid to reinvigorate its financial standing. While navigating this process, the company is committed to maintaining normal business operations and harnessing the opportunity to optimize its product lines. Reuters noted that ”Proterra, whose shares nearly halved in value after the bell, listed its assets and liabilities […]

Proterra has filed for Chapter 11 protection in a bid to reinvigorate its financial standing. While navigating this process, the company is committed to maintaining normal business operations and harnessing the opportunity to optimize its product lines.

Reuters noted that ”Proterra, whose shares nearly halved in value after the bell, listed its assets and liabilities in the range of $500 million to $1 billion. The company had a market value of $362 million as of last close. In January 2021, Proterra was valued at $1.6 billion, including debt, in a merger deal with a blank-check firm”.

This is the text of the press release shared on 7 August by Proterra:

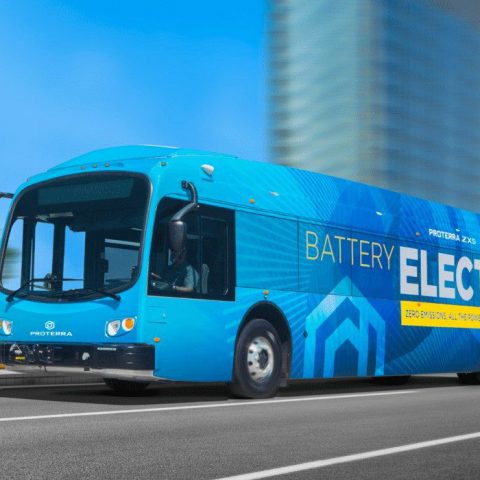

Proterra announced that the Company is taking action to maximize the value of its business and enhance the potential of each of its product lines. To do so, Proterra has voluntarily filed for protection under Chapter 11 of the U.S. Bankruptcy Code in the District of Delaware in an effort to strengthen its financial position through a recapitalization or going-concern sale.

The Company intends to continue to operate in the ordinary course of business as it moves through this process and plans to file the customary motions with the Bankruptcy Court to use existing capital to fund operations, including paying employee salaries and benefits, and compensating vendors and suppliers on a go-forward basis in accordance with Chapter 11 rules, all while ensuring business continuity for customers.

“Proterra is at the forefront of the innovations that are driving commercial vehicle electrification. We know we’re building industry-leading products that our customers want and need,” said Gareth Joyce, Proterra CEO. “The foundation we have built has set the stage for decarbonization across the commercial vehicle industry as a whole, and we recognize the great potential in all of our product offerings to enable this important transformation. This is why we are taking action to separate each product line through the Chapter 11 reorganization process to maximize their independent potential.”

“While our best-in-class EV and battery technologies have set an industry standard, we have faced various market and macroeconomic headwinds, that have impacted our ability to efficiently scale all of our opportunities simultaneously. As commercial vehicles accelerate towards electrification, we look forward to sharpening our focus as a leading EV battery technology supplier for the benefit of our many stakeholders,” said Joyce.