ZF: in 2023 sales increased by 6.5 percent to 46.6 billion euros

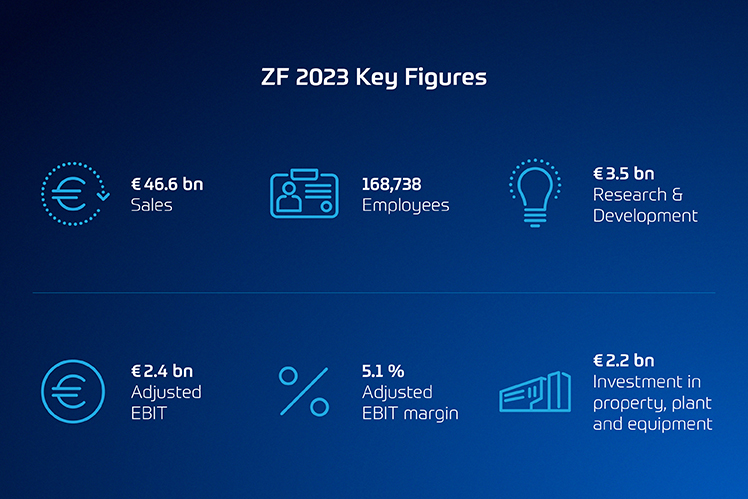

ZF achieved its financial targets set for 2023. Against the backdrop of a highly volatile global economy, the company increased sales by 6.5 percent to 46.6 billion euros (2022: 43.8 billion euros). Adjusted EBIT is 2.4 billion euros (2022: 2.0 billion euros); adjusted EBIT margin is 5.1 percent (2022: 4.7 percent). Thanks to positive free […]

ZF achieved its financial targets set for 2023. Against the backdrop of a highly volatile global economy, the company increased sales by 6.5 percent to 46.6 billion euros (2022: 43.8 billion euros). Adjusted EBIT is 2.4 billion euros (2022: 2.0 billion euros); adjusted EBIT margin is 5.1 percent (2022: 4.7 percent). Thanks to positive free cash flow in the second half of the year, ZF repaid liabilities of about 2 billion euros and reduced net debt by 400 million euros, bringing it below 10 billion euros.

“The year 2023 was a year of wide-ranging decisions for ZF. We reviewed the company’s transformation path and focused on competitiveness and profitability. Thanks to the hard work of the entire ZF team, we achieved our financial goals. Now we will continue on this path. 2024 will be a year of implementation, and we will set the course toward greater focus, efficiency and competitiveness,” said Dr. Holger Klein, CEO of ZF, at the budget presentation in Friedrichshafen.

ZF’s strategy

As Klein mentioned, a number of important decisions were made in 2023. One of these was the preparation for the merger of the Car Chassis Technology Division and the Active Safety Systems Division into the new Chassis Solutions Division on January 1 of this year. In addition, the spin-off of the Passive Safety Systems Division began. Another important step was the creation of a joint venture for car chassis systems, ZF Chassis Modules GmbH, with Foxconn, the world’s largest electronics manufacturer.

The decision to refrain from producing autonomous shuttles and instead focus on its role as a premium provider of autonomous driving technology and engineering services was also revolutionary for the Group’s long-term orientation. “This kind of decision allows ZF to act from a solid position and continue to implement its strategy. Our broad portfolio allows us to invest specifically in profitable growth areas and in electric mobility — depending on customer needs — in order to provide products for all-electric, hybrid and conventional propulsion,” Klein explained.

To become more globally competitive and respond to weak markets, ZF will use performance-related programs and focus even more on improving costs and structures. By the end of 2025, the cost base is to be reduced by 6 billion euros at the Group level. Five main areas will contribute to this goal. These include achieving material purchase price effects, increasing productivity, improving research and development costs and cost structure in business functions, and a detailed review of investments for their targeted use. “This leaner cost base will give us a strong position to address the further transformation to electric mobility in the second half of this decade and beyond,” Klein added.

Klein was echoed by Chief Financial Officer Michael Frick, who recalled how in fiscal year 2023, ZF repaid liabilities totaling about 2 billion euros. “Our priority is to systematically address debt reduction and refinancing.” Based on the ZF Green Finance Framework, three bond issues have been made: in February 2023, ZF issued a €650 million fixed-rate green euro bond under the Debt Issuance Program (DIP). In April 2023, ZF successfully re-entered the U.S. bond market with a volume of $1.2 billion. Another green euro bond was placed on the market in September 2023 with an individual fixed-rate tranche of 650 million euros. “These issues have all been in high demand. The markets continue to believe in ZF and our ability to manage transformation. We have already tapped into these successful issues this year to ensure a stable, long-term orientation of our maturity profile, even with changing financial market conditions,” Frick continued. A green bond placed on the market at the end of January with a volume of 800 million euros (five-year term, 4.75 percent coupon) was subscribed for eight times more than available.

ZF, the forecast for 2024

The forecast for fiscal year 2024 remains cautious, as it is still characterized by a weak economic environment with inflation and geopolitical conflicts. With stable exchange rates and considering planned corporate operations, ZF expects Group sales of more than 45 billion euros in 2024. This corresponds to an organic growth of 5 percent. With the expected development of sales and supply markets, along with the associated control of cost structures, ZF believes an adjusted EBIT margin of between 4.9 and 5.4 percent is achievable. Adjusted free cash flow from corporate operations is expected to exceed 800 million euros.