Electric bus registrations in the EU increased by 170 per cent in 2019

In the EU bus market, electric bus registrations increased by 170.5% from 594 units in 2018 to 1,607 buses sold in 2019. 85% of all new buses in European Union in 2019 were diesel-fuelled, with electric vehicles making up 4.0% of total new bus registrations. The figures coming from ACEA (European Automobile Manufacturers Association) take […]

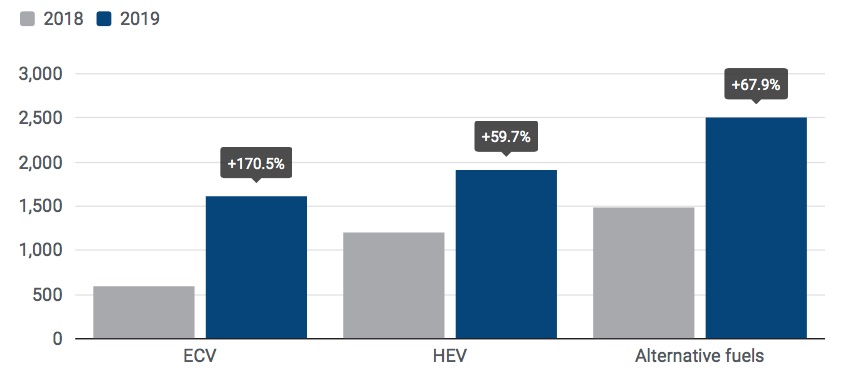

In the EU bus market, electric bus registrations increased by 170.5% from 594 units in 2018 to 1,607 buses sold in 2019.

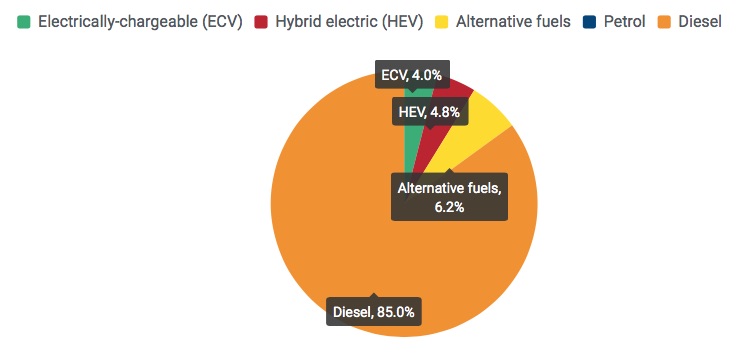

85% of all new buses in European Union in 2019 were diesel-fuelled, with electric vehicles making up 4.0% of total new bus registrations. The figures coming from ACEA (European Automobile Manufacturers Association) take into consideration all bus registration for buses over 3.5 tonnes. Although the 4 % share of electric drives could look like a marginal piece of the puzzle, it is worth considering that electric bus registration in the EU increased by 170.5% from 594 units in 2018 to 1,607 buses sold in 2019.

In the category (called ECV ‘electrically-chargeable vehicles’) ACEA include full battery electric vehicles, fuel cell electric vehicles, extended‐range vehicles and plug‐in hybrids.

Electric bus market, a boom in 2019

We at Sustainable Bus already addressed the topic of electric bus market in 2019 with reference to the figures provided by consulting firm Chatrou – CME Solutions, which showed a tripling of e-bus registration in 2019, with regards to Class I buses only. And with a focus on Western European country.

The total figure of e-bus registration, anyhow, show a very slight difference and remains around 1,600 units. While in the Class I market, e-buses accounted for a good 12 per cent of Class I buses in Western Europe (some 14,000 vehicles), on the total bus market in EU (34,000 vehicles) the share logically decreases to 4 per cent.

As widely known, the Netherlands represent the biggest market for these vehicles with 381 electric buses registered last year, followed by France (285) and Germany (187). Together, these three countries accounted for more than half of all electrically‐chargeable buses sold last year.

Diesel buses are 85 % of EU bus market 2019

Last year, ACEA points out, 85.0% of all new medium and heavy buses (over 3.5 tonnes) registered in the European Union (still including UK) were fuelled by diesel. All alternatively‐powered vehicles (APV) combined accounted for 15.0% of the EU bus market in 2019. Data for Bulgaria, Croatia, Malta, Lithuania and Iceland were not available.

EU bus market 2019, a decrease in the demand

Still according to ACEA’s figures, in 2019 EU demand for diesel buses decreased by 3.1% to 34,123 units. Four of the five major EU markets recorded double‐digit losses in the diesel segment: Spain (‐13.8%), the United Kingdom (‐12.0%), Italy (‐11.8%) and Germany (‐10.1%). France was the only market to post modest growth (+2.4%) in registrations of new diesel buses. Across the entire European Union, only eight petrol buses were sold in 2019.

EU bus market 2019, hybrid buses + 60%

With regards to the 15% of ‘diesel-free’ buses, 4 per cent belongs to ‘electrically-chargeable’ category, as already mentioned.

Hybrid buses (excluding plug-in hybrids) accounted for a 4.8 per cent: 1,918 units were registered across the European Union in 2019 according to ACEA’s data. It means 59.7% more than the year before. However, nearly all registrations were concentrated in just six countries: Germany (454 units), Spain (427), Belgium (371), Italy (255), France (210) and the Netherlands (125). Also mild hybrid buses are part of this figure. By contrast, no hybrid electric buses were registered at all in 13 EU countries in 2019.

Finally, 6.2% of all new buses sold in the EU last year ran on alternative fuels (natural gas, LPG, biofuels and ethanol vehicles), representing an increase of 67.9% to 2,504 registrations, nearly all of them being powered by natural gas. France (585 units), Spain (463), Italy (303) and Sweden (284) were the largest EU markets for natural gas buses, the latter also recording the highest percentage increase across the region (+283.8%).