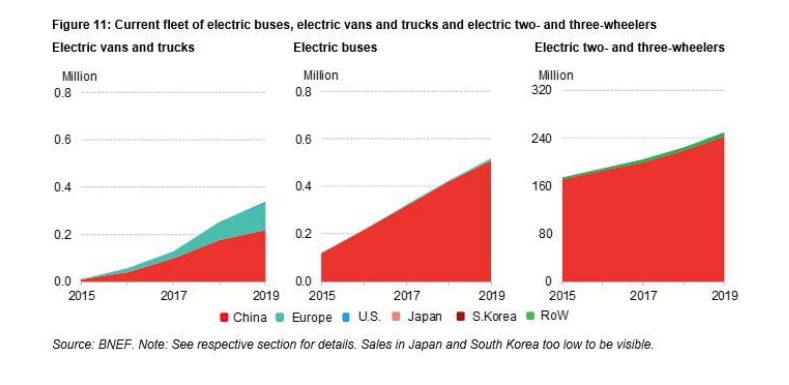

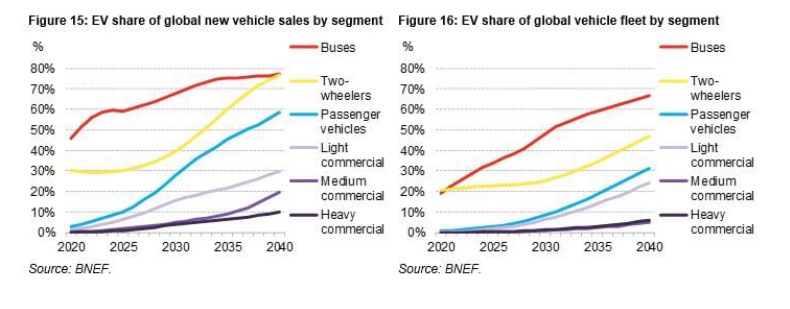

500,000 e-buses today in operation. They’ll take 67 of the global bus fleet by 2040, BNEF says

Today there are 500,000 e-buses in operation globally. And the share of battery-operated vehicles is bound to cover «over 67% of the global bus fleet in 2040». The figure and the forecast are pointed out in the newly-released Electric Vehicle Outlook 2020 by Bloomberg New Energy Finance (BNEF). What is interesting, in BNEF’s report, is that, according to the […]

Today there are 500,000 e-buses in operation globally. And the share of battery-operated vehicles is bound to cover «over 67% of the global bus fleet in 2040». The figure and the forecast are pointed out in the newly-released Electric Vehicle Outlook 2020 by Bloomberg New Energy Finance (BNEF).

What is interesting, in BNEF’s report, is that, according to the researchers, electric bus vehicles «will not fully take over the market. Diesel and eventually hydrogen fuel cell buses round out the rest of the fleet by 2040 in areas where installing charging infrastructure is difficult, or where temperatures are extreme, or near industrial clusters where hydrogen production is being deployed, or finally where local incumbents favor such technology».

Being more specific, according to BNEF, fuel cell applications will account for 6.5% of bus annuals sales in 2040. Oddly, the outlook doesn’t take into consideration gas-powered applications (either CNG or LNG).

Fuel cell vehicles to achieve higher adoption in bus field

In a few word, BNEF’s analysts attribute strong importance to hydrogen applications.

On one hand, fuel cell technology won’t scale up the passenger vehicle market: «Fuel cell vehicles (FCVs) represent just under 1% of the global passenger vehicle fleet in 2040. Even achieving this requires a thousand-fold scale up from the 20,000 passenger FCVs on the road today, and a dramatic reduction in the cost of producing green hydrogen».

On the other hand, according to BNEF Electric Vehicle Outlook 2020, «Hydrogen’s higher energy and power density makes FCVs better suited for applications involving heavier loads and/or daily long-distance travel. As a result FCVs achieve higher adoption rates in commercial vehicles and buses. By 2040, FCVs account for 1.5% of the medium-duty truck sales, 3.9% of heavy-duty and 6.5% of municipal bus global annual sales». According to BNEF, «FCV adoption will be geographically limited, with higher adoption rates in California, China, parts of Europe, Japan and South Korea. These are all regions with active plans for the deployment of hydrogen refueling infrastructure».

Electric vehicles outlook, battery prices still decreasing

With regards to electric bus battery cost, BNEF confirms its previous outlook, which forecast a price below $100/kWh of lithium-ion battery packs by 2024. Finally, they’ll reach «$61/kWh by 2030, but high levels of investment will be needed to keep prices falling».

This will be driven «in part by the introduction of new cell chemistries and manufacturing equipment and techniques». «EV battery demand has a slow start to the decade, with 2020 shipments 14% lower than in 2019. But by 2030 demand grows almost 14-fold to 1,755GWh. Manufacturers have announced plans totaling 1,769TWh of annual capacity planned by 2025. China still dominates, but capacity is growing in other regions», the reports says.

BNEF forecasts that «around 2023, lithium nickel manganese cobalt aluminum oxide (NMCA) will start to enter the EV market. This provides higher energy densities and a longer cycle life than the equivalent NMC or NCA material». And what about production capacity? «Lithium supply looks sufficient for the 2020s – BNEF writes -, but new cobalt mining capacity will need to come online to avoid a supply crunch. We do not expect any long-term shortage of these materials to persist».

Transport electrification, particularly in the form of two-wheelers, is already taking out almost 1 million barrels of oil demand per day and by 2040 it will remove 17.6 million barrels per day. Electric vehicles (EVs) of all types are seen adding 5.2% to global electricity demand by 2040, according to BNEF.

Coronavirus crisis and public transport, bad news…

With regards to Covid-19 consequences and focus on passenger cars, «Sales of electric passenger vehicles are forecast to fall 18% in 2020, to 1.7 million worldwide – with the coronavirus crisis interrupting ten successive years of strong growth. However, sales of combustion engine cars are set to drop even faster this year (by 23%), and the long-term electrification of transport is projected to accelerate in the years ahead».

The report also discusses the impact of the coronavirus crisis on public transit. It sees more than a short-term effect as lockdowns ease. Instead, there is likely to be a lasting reduction in ridership of municipal bus and metro services, and more traffic congestion in cities. Shared mobility operators have suffered, but will rebound quickly on the back of food delivery, logistics and micromobility services.