We visited Forsee Power’s plant in Poitiers (France): production capacity set to grow 100% by 2028 (up to 4 GWh/year)

On 27th February 2024 our editorial staff had the opportunity to visit Forsee Power‘s industrial plant in Poitiers, France. Situated on a brownfield investment dated 2018, the facility was previously used as a diesel engine piston plant. Our visit offered a glimpse into a facility transformed into a hub of modern energy solutions, with a […]

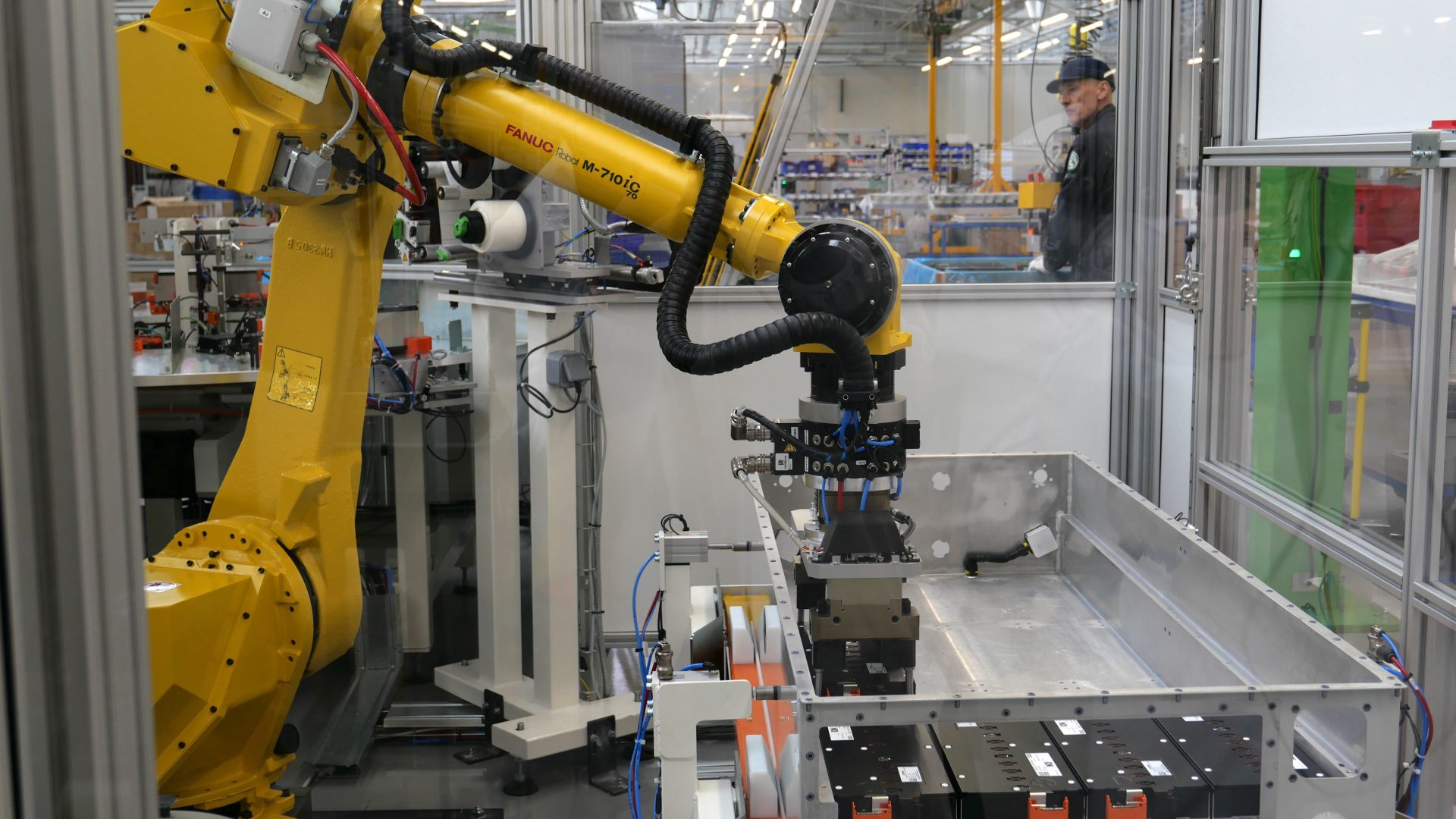

On 27th February 2024 our editorial staff had the opportunity to visit Forsee Power‘s industrial plant in Poitiers, France. Situated on a brownfield investment dated 2018, the facility was previously used as a diesel engine piston plant.

Our visit offered a glimpse into a facility transformed into a hub of modern energy solutions, with a significant focus on e-bus technology. And more reporting on our visit will come soon!

Forsee Power: focus on the e-bus market

Notably, e-bus-related business covers roughly two thirds of Forsee Power’s sales, meaning a straight focus on the public transport market. The French supplier is indeed battery partner of brands such as Wrightbus (that placed fourth on the European e-bus market 2023), Van Hool, Iveco Bus (although also in-house assembled modules are going to be mounted on the new generation E-Way, as a further option besides Forsee’s battery system), CaetanoBus. Over 3,000 e-buses are equipped with Forsee Power batteries so far, according to company’s figures.

The facility in Poitiers spans 10,000 square meters for production, with an additional 2,500 square meters dedicated to components and 2,000 square meters for shipping operations.

Forsee Power on its way to positive EBITDA

Forsee Power specializes in battery packs for both first-life and second-life applications, and had experienced a 54% growth in revenue from 2022 to 2023 (up to €171.4 million). The share of heavy vehicles represented 85% of sales in 2023, compared with 79% at the end of 2022. Their products are utilized across various sectors, with a focus on heavy commercial vehicles (truck and buses), heavy machinery, rail, light vehicles such as 3-wheelers and scooters. Concerning cell providers, Forsee’s preferred (but not only) partners are LG, CALB, and Toshiba.

In terms of products, the latest news of the company is the addition of LFP formula in its offering, announced in September 2023, besides NMC and LTO-based products.

Looking forward, Forsee Power aims to achieve equilibrium in EBITDA by 2024, with a projected 15% positive EBITDA by 2028. Plans for expansion include scaling up production in Poitiers (today installed capacity of 2 GWh) to 4 GWh by 2028, alongside developments in the company’s other facilities in Poland, China, India, and the USA.