Fuel cell bus projects in the spotlight: fleets, manufacturers, trends

In the first half of 2025, a total of 279 hydrogen buses were registered in Europe, a 426% growth on the 53 registered in January – June of last year. 2024 ended with a record figure of 378 H2 buses registered… this year we are already at 74% to achieve the same volume. However, despite promising potential, […]

In the first half of 2025, a total of 279 hydrogen buses were registered in Europe, a 426% growth on the 53 registered in January – June of last year. 2024 ended with a record figure of 378 H2 buses registered… this year we are already at 74% to achieve the same volume.

However, despite promising potential, the current state of hydrogen technology in the bus market remains marginal: in 2024 hydrogen buses covered just 4.6 of the zero emission bus market, with BEV buses covering the remaining 95%. In the first half of 2025 the share remained quite the same: 5.2% fuel cell buses vs 94.8% BEV buses.

As of mid-2025, Solaris is by far the European market leader in fuel cell buses. In the period January – June 2025 the Polish company registered 163 vehicles for a market share of 58%. As of end 2024, Solaris had deliver a total of 425 fuel cell buses in Europe, even to a 44.5% percent market share.

The largest single fuel cell bus tender so far has been awarded to Solaris in September 2023: 130 Urbino 12 hydrogen will be deployed in Bologna (Italy) by TPER within 2026. And Solaris was leading the market in 2024 with 225 deliveries, followed by Wrightbus and CaetanoBus.

Making a few step behind, a total of 370 fuel cell buses were in operation in Europe as of 1 January 2023. But there were plans to get over 1,200 by 2025. In Europe 2021 had been a watershed year: with 158 registrations, that market grew of 236% in Europe. In 2022, on the other hand, registrations in the Old Continent decreased: 99 units. Many funding schemes are in place in Europe nowadays (we tried to take stock of the situation here).

| Year | Fuel cell buses over 8 ton registered in Europe |

| H1 2025 | 279 (+426% on H1 2024) |

| 2024 | 378 (+82%) |

| 2023 | 207 |

| 2022 | 99 |

| 2021 | 158 |

Fuel cell buses: for cities or highways?

As proved by the plans put in place by most of the heavy-duty truck players, hydrogen fuel cell technology is gaining ground as the preferred option for the ‘post-diesel’ future in long-haul operations (with MAN at the moment on a quite different position…). According to a report by Interact Analysis, 74% of coaches are estimated to be non-electrified in 2030 in EMEA region. In that segment, for a few years we’ll mostly see plans, targets and pilot projects.

However, at the moment most of the fuel cell buses are working in urban and suburban environment, where they provide, balancing the higher cost for purchase and operate, some significant advantages exemplified by Vienna’s choice to go for hydrogen for the city center’s routes: “charging infrastructure is no longer required in the city centre and the vehicle fleet for routes 2A and 3A can be reduced from 12 to 10 buses”, stated the company when, in July 2024, issued an order for 10 Rampini fuel cell buses set to replace 12 BEV buses from the same supplier.

The evolution of fuel cell bus concepts in Europe

It must be said that a nice slice of buses that are still in service today actually dates back to projects developed before the battery-electric frenzy that led to a massive abandonment of fuel cell bus projects (to name but one example: Mercedes). Projects that are currently being resumed with a refreshed perspective: some ten years ago, fuel cell technology was promoted as a solution for urban buses, while nowadays there is general agreement on FCVs as a future alternative to diesel for medium and long-range travel, from suburban routes to long distance transport.

However, today’s fuel cell buses have a significant difference compared with those launched ten years ago: the only concept available today see the fuel cell module working together with a small battery, with the latter being charged by the fuel cell and powering the motor. More properly said: fuel cell hybrid electric buses.

Fuel cell bus: focus on costs

According to Bart Biebuyck, Executive Director of the FCH JU, (statements dating June 2020) «360 hydrogen buses should be on the road in 2021 in the framework of JIVE 1 and JIVE 2 projects. And costs? The first hydrogen bus in 2010 had a price of 1.8 million euros. Today, the H2Bus Consortium has set the goal of reducing that figure to 650,000 euros» he told in an interview with Sustainable Bus.

However, aside upfront cost, operational costs are another issue. A study by Eurac Research out in September 2023 found that, for the same mileage, FCEB operating costs are 2.3 times higher than those of BEBs. The study, published in the Journal of Energy Storage, contains insightful data on the efficiency of battery electric buses and fuel cell buses and on their energy consumption with a focus on running costs for the two technologies (not the TCO, then).

Well, according to Eurac’s calculations, the operating costs for BEBs and FCEBs end up being €0.55/km and €1.27/km, respectively. This means that, for the same distance, FCEB operating costs are 2.3 times higher than those of BEBs.

Daimler – Volvo: welcome Cellcentric

Daimler Truck AG and Volvo Group officially outlined the strategy beyond the fuel cell joint venture Cellcentric, first announced in april 2020, in April 2021.

The roadmap is part of an industry-first commitment to accelerate the use of hydrogen-based fuel cells for long-haul trucks and beyond (also long distance coaches will be part of this development.

With the ambition of becoming a leading global manufacturer of fuel-cell systems, Cellcentric (founded in March 2021) is expected to build one of Europe’s largest planned series production of fuel-cell systems, with operation planned to commence in 2025. To accelerate the rollout of hydrogen-based fuel-cells, the two cellcentric shareholders call for a harmonized EU hydrogen policy framework to support the technology in becoming a viable commercial solution.

Fuell cell buses: the market offering in Europe

Solaris Urbino hydrogen, launched in 2019

In 2019, taking the opportunity of the UITP Global Public Transport Summit, Polish manufacturer Solaris Bus & Coach launched its first fuel cell bus Solaris Urbino hydrogen.

Solaris fuel cell bus is basically structured as its battery-electric counterpart, hence made of stainless steel but sporting roof-mounted hydrogen tanks as its distinctive feature. The traction system is unchanged. Batteries are smaller than on the Urbino Electric: the bus ordered by SASA will be fitted with 30 kWh of High Power, the type designed for quick charging, by virtue of its high maximum charging power. The beating heart of the hydrogen bus is the fuel cell FCmove-HD 70 kW stack by Ballard Power Systems, the main global player providing fuel cells to heavy-duty commercial vehicles. Ballard can boast collaborations with Van Hool and VDL, and with the British bus builder Wrightbus.

As of mid-2025, Solaris is by far the European market leader in fuel cell buses. In the period January – June 2025 the Polish company registered 163 vehicles for a market share of 58%. As of end 2024, Solaris had deliver a total of 425 fuel cell buses in Europe, even to a 44.5% percent market share.

CaetanoBus: the hydrogen bus with Toyota tech

The CaetanoBus H2.City Gold was initially notable for offering a fuel cell city bus in shorter lengths, with 10.7- and 12-metre variants, filling a market niche for compact hydrogen buses.

The cooperation with Toyota has been extended in late 2020, when it was announced a strategic alliance: Toyota Europe has joined forces with CaetanoBus and Finlog in an effort dedicated to the development and production of fuel buses in Europe.

Building on this foundation, the manufacturer has unveiled at Busworld Europe 2025 a new, expanded family spanning 8.5 to 18 metres, which includes a 12-metre solo bus and an 18-metre Bus Rapid Transit (BRT) model. Fuel cell technology remains based on Toyota’s Generation 2.5 Fuel Cell Stack delivering 70 kW, now complemented by larger CATL battery packs—up to 130 kWh for 12-metre FCEVs and 170 kWh for 18-metre models.

What is new (and relevant), CaetanoBus buses are now built on a CRRC platform including powertrain systems, a compact 6-in-1 inverter that integrates motor, generator, DC/AC oil pump, air compressor, DC/DC conversion, and high-voltage distribution.

Caetano fuel cell bus H2.City Gold is also the only model shorter than 12 m. While Solaris reserves hydrogen for its 12 m and Van Hool already has the 12 m and 18 m on the range, Caetano offers a 10.7 m variant. Though matching the high costs of hydrogen technology to a low passenger capacity model may look like a gamble, this version has the merit of filling a gap in the market.

A curiosity: CaetanoBus and Industria Italiana Autobus (IIA) had signed an agreement in October 2022 to start the production and marketing in Italy of hydrogen-powered city buses based on Toyota Fuel Cell technology and an H2.City Power Kit system developed by CaetanoBus. But the deal expired quite soon as Industria Italiana Autobus changed ownership…

Mercedes eCitaro: hydrogen as range extender

The Mercedes-Benz eCitaro fuel cell marked a major step in Daimler Buses’ zero-emission strategy, debuting at the UITP Summit 2023 in Barcelona as a range-extended evolution of the battery-electric Mercedes eCitaro.

Available also in articulated configuration (launched in 2024) with capacity for up to 128 passengers, the model combines NMC3 batteries (up to 392 kWh) with a Toyota-supplied fuel cell module acting as a hydrogen generator, extending the range to around 350–400 km without recharging.

Unlike most fuel cell buses, which rely on small LTO batteries, the eCitaro fuel cell retains substantial battery capacity, positioning it as a hybrid between battery-electric and fuel-cell technology. The articulated eCitaro G version features six to seven hydrogen tanks (5 kg each) feeding a 60 kW fuel cell optimized to operate efficiently between 20 and 30 kW and expected to last about 40,000 hours.

Potrebbe interessarti

Test-driving the Mercedes eCitaro G fuel cell

Hydrogen refueling takes roughly ten minutes, and the heat from the cell is used to regulate cabin and battery temperature. Equipped with ZF AxTrax electric axles, a power output of 141 kW per drive wheel, and advanced safety systems such as Preventive Brake Assist and Sideguard Assist, the eCitaro fuel cell entered series production in late 2023, with Rhein-Neckar-Verkehr as its first customer.

Looking at the long term, in 2039 Daimler Trucks & Buses plans it will be selling only battery-electric and hydrogen powered buses and trucks, at least in the main markets of Europe, North America and Japan.

Karsan e-ATA Hydrogen, from 2022

Karsan entered the hydrogen mobility arena in 2022 with the debut of the e-ATA Hydrogen at the IAA Transportation in Hannover.

The 12-meter model, powered by a 70 kW fuel cell by Ballard and a 30 kWh LTO battery for peak demand and auxiliary energy, delivers up to 250 kW and 22,000 Nm through a ZF electric portal axle, offering a range of over 500 km and refueling in under seven minutes. More specs? Capacity for more than 95 passengers, advanced driver assistance features, and a CO₂-based air conditioning system.

Two years later, in 2024, Karsan announced a partnership with Toyota to integrate Toyota Fuel Cell Modules into its hydrogen buses from 2025 onward — a move that strengthens its technological portfolio and aligns it with Toyota’s European hydrogen ecosystem, alongside players such as CaetanoBus and Daimler Buses. According to CEO Okan Baş, this cooperation underscores Karsan’s intent to “maintain its claim in the field of hydrogen” and lead the transition toward zero-emission public transport solutions.

Iveco E-Way H2

Iveco Group and Hyundai Motor Company on 6th October 2023 unveiled the first Iveco Bus E-Way H2 at Busworld. The hydrogen-powered fuel cell electric bus is another concrete result of the partnership the two companies announced in March 2022 and reflects their commitment to accelerate the transition towards net zero carbon mobility and transport. The new model will expand the Iveco Bus zero-emission solutions for cities.

The E-Way H2 is a 12-meter-long low-floor city bus equipped with a 310-kW e-motor and a fuel cell system provided by HTWO, a fuel cell system-based hydrogen business brand of Hyundai Motor Group. With four tanks offering a combined storage of 7.8 kg of hydrogen and one 69 kWh battery pack by FPT Industrial, Iveco Group’s brand specialised in powertrain technologies, the vehicle offers a driving range of 450 km under normal operating conditions, Iveco Bus states.

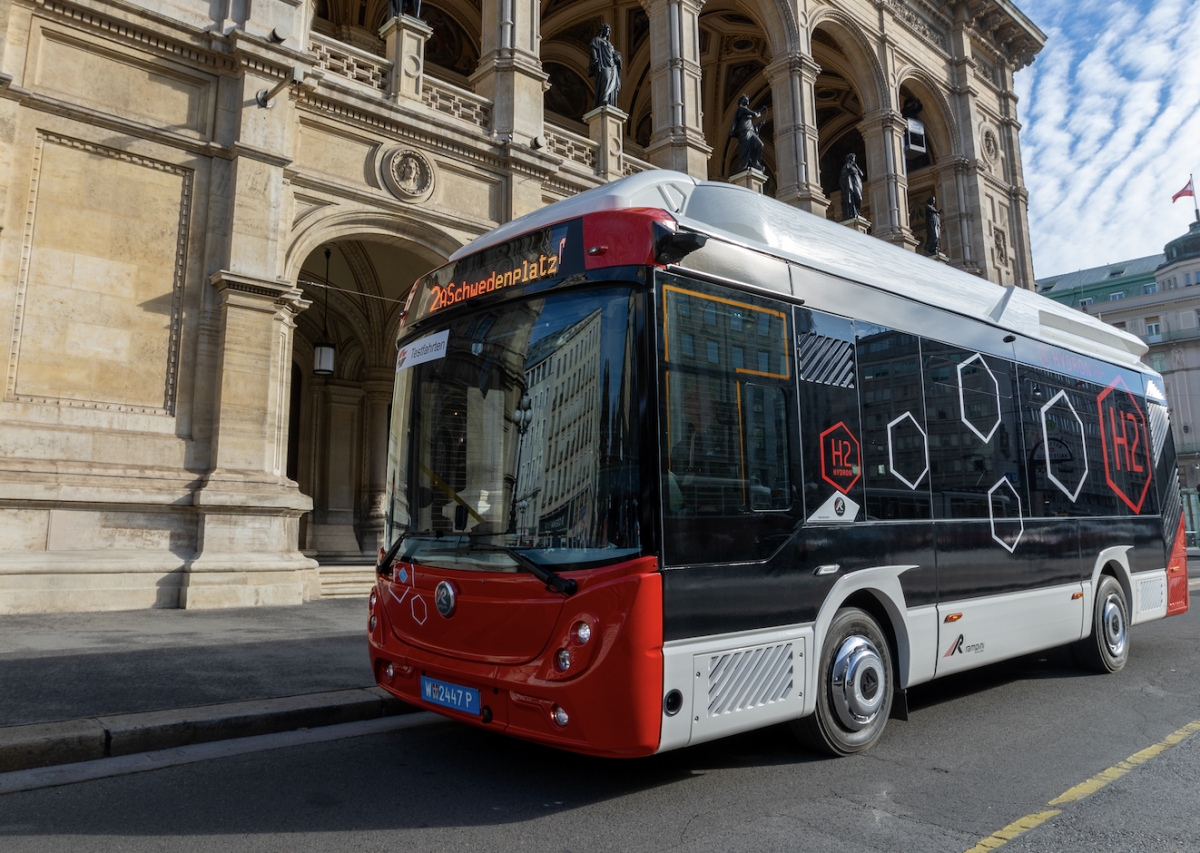

Rampini Hydron: the first and only 8-meter fuel cell bus

Rampini unveiled in September 2022 the Rampini Hydron, powered by hydrogen fuel cell: announced in late 2020, Rampini Hydron is an 8-meter long hydrogen bus capable of transporting up to 48 people and features a stated range of 450 kilometers. It is the first H2-powered 8-meter bus in Europe. Canadian Loop Energy has been chosen as fuel cell module provider. A 10-units order was landed in late July 2024 by Wiener Linien.

Skoda H’CITY 12

Skoda entered the fuel cell bus segment at InnoTrans 2022, where the Czech company launched the new hydrogen-powered Škoda H’CITY 12 bus. The vehicle is based on the very same platform as the E’CITY e-bus and the trolleybus Skoda T’CITY, both launched in the same year.

Škoda H’CITY 12 bus uses PEM fuel cells as its power source, in which hydrogen (stored in roof-mounted tanks with capacity 39 kg) and oxygen reactions take place, and batteries in which the energy produced is stored.

Safra: from Businova to Hycity and beyond

Safra entered the hydrogen bus market in 2019 with the Businova H₂, developed in collaboration with Symbio, Michelin’s hydrogen subsidiary. The model featured a bi-modular chassis and a hybrid powertrain combining a 30 kW fuel cell module (Symbio H2Motiv) and a 132 kWh battery, providing a range of around 300 kilometres. The first units were delivered to Artois-Gohelle and Auxerre, positioning Safra among the early European adopters of fuel cell technology for public transport.

In 2022, the company unveiled its new-generation Hycity, featuring a 75 kW fuel cell, Microvast batteries, and components from ZF and Thermo King. The 12-metre bus offered a range of up to 350 kilometres and capacity for over 100 passengers, consolidating Safra’s focus on high-quality, zero-emission design made in France.

After a period of receivership, the company was acquired by China’s Wanrun Mining Group and rebranded as Safra New Mobility in 2025. Under this new ownership, Safra has broadened its strategy beyond hydrogen buses to include battery-electric minibuses and vans, while maintaining production and adaptation capabilities in Albi, France.

At Busworld Europe 2025, the manufacturer presented an updated Hycity (hydrogen version with 250 kW electric axle, 75 kW fuel cell, and 80 kWh battery, up to 500 km range) alongside a forthcoming battery-electric Hycity co-developed with Chinese partners. The new lineup also includes the Inycia electric minibus and Evanya electric van, marking a transition from a single-model hydrogen focus to a diversified, multi-platform zero-emission portfolio supported by industrial cooperation with Asian suppliers.

Irizar with the fuel cell coach

In 2023 Irizar has ‘donated’ to attendees at Busworld Europe one of its most important innovations. Busworld 2023 may go down in the annals for hosting the first presentation of a hydrogen-powered coach. In Brussels Irizar unveiled the Irizar i6S Efficient Hydrogen. Lot’s of hype!

Pilots, experiments, insolvencies, attempts…

Van Hool, fuel cell buses since… years. Before bankruptcy…

As of December 2020, Van Hool (that in 2024 filed for bankruptcy and was taken over by Dutch VDL) fuel cell buses have travelled for 10 millions kilometres. 141 vehicles had been sold until end 2020 (delivered or on order). What is more, Van Hool has got significant follow-up orders from customer such as Qbuzz in Groeningen, that bought 2 vehicles in 2017 and has ordered 30 units more in 2020, and RVK Cologne, which is adding 35 fuel cell buses to the existing two.

2019 has been a significant year for the Belgian manufacturer, with regards to hydrogen bus activities: the new A330 FC hydrogen bus and the innovative Van Hool Exqui.City 18 FC bus have been launched. The latter debuted in December 2019 in Pau, south of France. It stands out for being the world’s first hydrogen-powered BRT system. Eight Van Hool Exqui.City FC 18-meter hydrogen buses serve 14 stations along a six kilometre long dedicated BRT lane with priority at crossroads.

Here’s the position of Van Hool’s CEO Filip Van Hool with regards to commercial viability of fuel cell solutions: «Hydrogen buses are already competitive when you compare them with battery buses. In many cities there have been tests on battery buses in these years, and the conclusion very often is that the battery electric bus is good inside the city because it has limited range. When operators need more range, there are some problems. It is impossible to replace one diesel bus with one battery electric bus: you need more battery electric buses, because of longer charging times and limitation in range. I think battery buses and hydrogen buses will coexist. If the operator doesn’t want to double the number of vehicles and needs longer range the best application is hydrogen. But we don’t believe only on hydrogen: we have also battery buses in portfolio. Today is necessary to have everything. You know why?»

Hyzon Motors, towards the fuel cell bus field

What is very interesting in TMB Barcelona’s tender mentioned above is that three bids were submitted: beyond CaetanoBus and Solaris, an offer was presented by Hyzon Motors Europe B.V. / Holthausen Clean Technology B.V., the joint venture established by the new player Hyzon Motors in the European market.

Hyzon Motors has been officially launched in mid-March 2020, and follows the experience developed from Horizon Fuel Cell Technologies. Announced as a company specialized in hydrogen heavy-duty vehicles based in New York State, Hyzon said that series production of its vehicles (trucks and buses) is to begin late this year. On April 4th 2020 Hyzon Motors’ stated on Linkedin that «Hyzon Motors Inc. announces that 1,000 units 40FT/12M fuel cell bus MOU (Memorandum of Understaing) was signed with a client under confidentiality. Target to deliver the first 50 units in about 12 months after formal contract».

In an interview we had with Hyzon Motors’ CEO Craig Knight in November 2020, he told us that «we are looking also at the opportunity to work with European bus builders in order to take part in hydrogen bus tenders. We don’t make chassis and full vehicles: we are focused on fuel cell powertrains and hydrogen systems, so it’s important for us to put partnerships in place. We want to be more active in Europe. We will move to a larger facility in 2021 that will enable series production. We plan to become a lot more aggressive in 2021 in terms of participation in tenders and we will be working on a vehicle range for the European market with our fuel cell technology».

Hydrogen buses, VDL made some first steps… and stopped

A metaphorical award for the most original hydrogen bus layout to date goes to the VDL-made fuel cell buses deployed in the Netherlands by Connexxion starting in summer 2020. The vehicles are realized adding a trailer (housing the fuel cell technology) to the bus, that actually results in a battery-electric bus with fuel cell range extender.

The range extender system has been developed by Bosch Engineering GmbH together with VDL Enabling Transport Solutions within the scope of EU-funded GiantLeap project. Fuel cell stacks are provided by Ballard Power Systems. The vehicles operate between Rotterdam and the Isle of Goeree Overflakkee.

Hydrogen for long distances: Flixbus prepares the ground?

FlixBus announced in late 2019 that the group is working to prepare the introduction of hydrogen buses in its long distance bus network. A collaboration between the green and orange colored brand and Freudenberg Sealing Technologies, aimed at studying this possibility, has been launched.

In the future, the partnership will be enriched by the contribution of a bus manufacturer. FlixBus and Freudenberg, they announce, are currently holding talks to finalize project parameters. According to the information made public so far, a representative bus fleet of 30 Flixbus fuel cell buses is expected to be equipped with a hybrid powertrain (that combines fuel cell module with battery packs) to validate system performance. The two companies are also aiming for public funding within the framework of the German “National Innovation Program Hydrogen and Fuel Cell Technology” (NIP).

Europe: three initiatives on fuel cell coaches

In Europe, three initiatives focused on the development of fuel cell coaches have been announced so far. Firstly, FlixBus launched the HyFleet project in collaboration with partners Freudenberg Fuel Cell e-Power Systems and ZF in 2021. The project aims to conduct research and advance fuel cell technology. Goal: having hydrogen long-distance buses on the European network by 2024. The minimum range request is 450 km on a single refilling. “A European bus manufacturer will also join the project in the future”, it was stated at the time.

In a February 2022 interview with Sustainable Bus magazine, Michael Milch, Director of Program Management at Freudenberg Fuel Cell e-Power Systems GmbH, emphasized FlixBus’s recognition of the necessity to adapt fuel cell technology for heavy-duty applications. Milch highlighted that the existing fuel cell technology primarily stems from passenger car technology, with a typical lifetime of 5,000 to 8,000 hours. However, the heavy-duty sector demands higher durability: he says that Freudenberg has developed a dedicated heavy-duty design approach to meet this requirement, targeting a minimum lifetime of 35,000 hours.

Secondly, the CoacHyfied project, led by the service provider FEV Group, was launched in March 2021. With partners including Ballard Power Systems, ElringKlinger, Otokar, Engie, and Ford Otomotiv Sanayi A.Ş, a Turkish Ford subsidiary, the project brings together expertise from various sectors to drive advancements in fuel cell technology. The total project duration is scheduled for five years. In the course of CoacHyfied project, two types of coaches will be investigated: OEM-based, newly produced fuel cell buses, and existing buses that have been converted to fuel cell propulsion.

Fuel cell buses in the US

In the US, an hydrogen bus fleet began operations in early February 2020 operation with the livery of Orange County Transportation Authority (OCTA) in Santa Ana, California. The vehicles, model New Flyer Xcelsior CHARGE H2, were delivered following the order signed in early 2018. The vehicle was announced to have completed Altoona Test in March 2019.

In addition to launching the hydrogen bus fleet, OCTA also debuted the largest hydrogen fueling station in the nationfor public transportation, showcasing its $22.6 million investment in zero-emission transit.

CTE: fuel cell buses appropriate to large scale deployment

Dan Raudebaugh, Executive Director for the Center for Transportation and the Environment (CTE), told Sustainable Bus in an interview made in October 2020: «I think fuel cell buses will play a significant role in transit over the next 10 to 20 years. The early market deployments are being dominated by battery electric buses because battery electric buses are much simpler and more cost effective to deploy in small numbers. I think fuel cells and hydrogen will start to shine more with larger scale deployments. Converting five to 20 buses is pretty straightforward, and battery electric buses have shown to be a clear winner in this scenario. Transit agencies can usually find space for charging infrastructure in their depot, and have enough shorter blocks for battery electric buses. Fuel cells become very competitive when you look at converting 50 to 100 buses, especially if you deploy them all from the same bus yard. Fuel cells hold the promise of supporting those longer blocks and can be very price competitive in numbers of 50 or more».

Fuel cell bus deployment, focus on Asia. According to BloombergNEF

According to BloombergNEF EVO2020 report, «FCVs achieve higher adoption rates in commercial vehicles and buses». As of late 2020, mentioning what Aleksandra O’Donovan, Head of Electrified Transport at BloombergNEF, told us in an interview published on Sustainable Bus magazine #2, there were «about 4,250 fuel cell buses on the road, a fraction of the global bus fleet (1.5 million units). We expect to see uptake of fuel cell buses over the next 20 years in China, South Korea and Japan. China and South Korea in particular are now promoting fuel cell technology as the countries attempt to build a new industrial value chain around it. However, due to the economic advantage and advanced adoption rates of e-buses over fuel-cell buses, we believe the latter to play a complimentary role to e-buses, especially for hard to electrify routes».

After all, China always proves to be ahead when it comes to the transition to zero emission buses. The city of Nanjing, for instance, is planning to switch the battery-electric bus fleet (that amounts to no less than 7,000 vehicles) to hydrogen.